- 1 of 3 Americans buy a streaming service to watch a game

- Netflix and Amazon remain streaming kings

- Cable TV subscriptions decline to 1 of 5 Americans

- Free streaming services: the new frontier for sports?

Is there any doubt why ESPN will unveil their streaming option in Fall 2025? Or why will YouTube, Peacock, and Netflix carry 2025 NFL games? The nation’s consumer behavior demands it. Streaming services owe a great deal to sports fans.

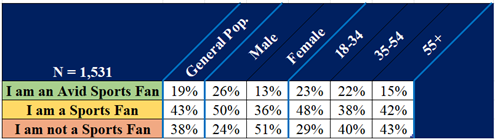

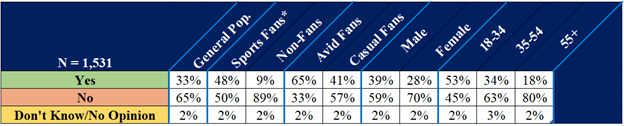

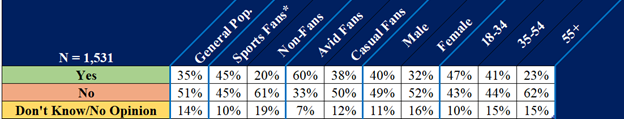

That is particularly true when Americans invest in the purchase of a streaming service for the sole purpose of watching a game. One-third of the general population bought (33%) a streaming service for this reason, while a similar percentage of Americans (35%) indicated they will retain that streaming service subscription for at least three months.

Now, add the sports fans. The purchase and retention behavior percentage jumps to nearly half of those who consider themselves Sports Fans (48% purchase; 45% retention), and nearly two-thirds of Avid Fans (65% purchase; 60% retention). This trend is even stronger among younger fans (18-34 subgroup) who indicate they will subscribe to watch a game (53%) and nearly half will retain the service for three months (47%).

“Sports fans are reliable, loyal, and good consumers driven by their devotion to their sport and team,” said Charles Grantham, Director of the Center for Sport Management in the Stillman School of Business at Seton Hall University. “For decades, fans have made leagues and media networks adapt to their viewing habits. It is dramatically changing the strategies of companies as prestigious as Netflix, Amazon, and Disney, while enriching the future of leagues like the NFL and NBA, and all professional athletes.”

These are among the broad results from a Seton Hall Sports Poll conducted April 21-23rd among 1,531 adults. The Poll, which is sponsored by The Sharkey Institute within Seton Hall University’s Stillman School of Business, features a national representative sample from YouGov Plc. weighted on U.S. Census Bureau figures for age, gender, ethnicity, education, income and geography and has a margin of error of +/-3.0 percent.

Entertainment for All: The Demographic Reach of Streaming Giants

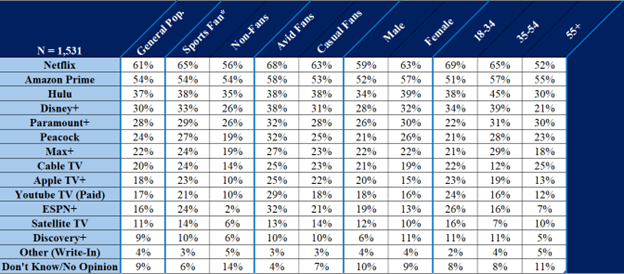

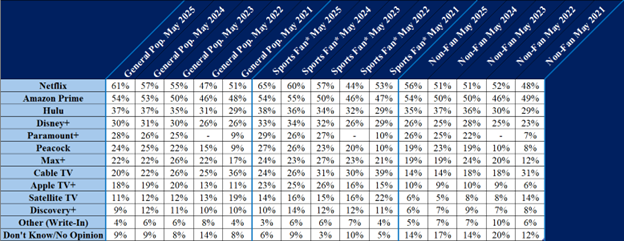

Netflix and Amazon continue to outperform competitors not only in total subscribers, but in cross-demographic appeal and retention. Data from the Poll shows Netflix subscribers reaching 61 percent of Americans and an even stronger 68 percent among Avid Fans – a group once beholden to Cable TV packages. Amazon Prime shows similar momentum, reaching 54 percent of Americans and 58 percent among avid fans.

Unlike platforms that rely heavily on niche audiences, both services have maintained relevance across diverse age groups, genders, and levels of fandom. For instance, Netflix leads among both Males (59%) and Females (63%) and remains the most subscribed to for both 18-34 (69%) and 35-54 (65%) subgroups. Amazon Prime’s consistency across these same groups, particularly among those 35 and older, reflects its unique blend of entertainment and utility, where streaming is seamlessly bundled with the everyday convenience of Amazon.com.

Cable in Crisis?

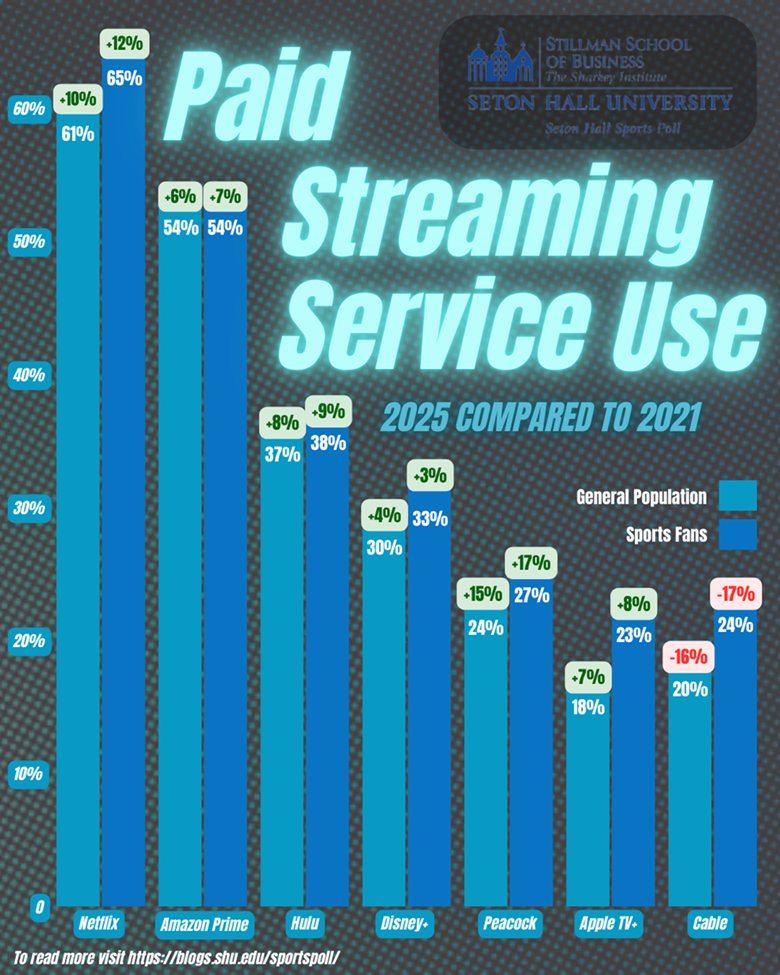

At the same time, cable TV’s continued decline highlights a broader generational and behavioral shift. Only 20 percent of Americans reported having a cable package in 2025; a 16-point drop from 36 percent in 2021. Sports Fans, one of cable’s strongest customer bases, also continues to decline, with subscription percentages falling from 36 percent in 2021 to just 24 percent in 2025.

As younger viewers (18-34) overwhelmingly choose platforms like Netflix (69%) and Amazon Prime (57%) over cable (12%), it is increasingly unlikely that cable will ever recover its lost ground in the years to come. The rise of bingeable content, customizable recommendations, and hybrid platforms offering both scripted series and live sports have made streaming more attractive.

Is Free Streaming TV the Future?

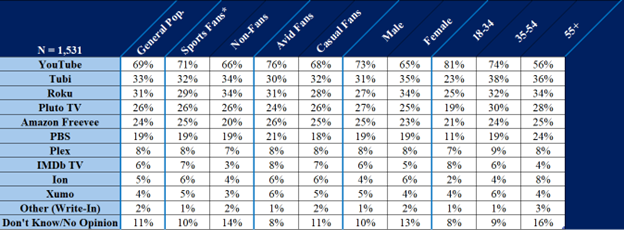

With cable TV on the decline, we are seeing a slew of free streaming platforms looking to replace it. YouTube stands out as a dominant player in the free streaming market (69%), but Tubi is next with 33 percent of American households and 32 percent of the sports fans using it. The 2025 NFL Super Bowl aired on Tubi—a free streaming service.

Tubi offers a variety of live sports channels including, but not limited to, the NFL, Fox Sports, and the NBA. Trailing close behind is Roku—another free service with a dedicated sports page and live sports events—covering 31 percent of the general population’s households and 29 percent of the sports fans’ households.

“The intensity of the competition to capture the viewers and users of sport – mirrors what happens on the court and fields of play,” said Dr. Daniel Ladik, Marketing Professor in the Stillman School of Business and Methodologist for the Poll. “Owners, commissioners and now private equity markets are aware of this new consumer behavior. The great shift from cable to streaming subscriptions has been underway for quite some time now. Does this signify that another turning point to free streaming is imminent? This is certainly a topic the Poll will continue to monitor.”

April 2025 Seton Hall Sports Poll

Daniel Ladik, Ph.D., Chief Methodologist – Daniel.Ladik@shu.edu

This Poll was conducted April 21st through April 23rd and includes responses from 1,531 U.S. adults, with a margin of error of +/-3.0%. The sample mirrors the U.S. census percentages on age, gender, income, education, ethnicity, and region. Previous Polls can be found at https://blogs.shu.edu/sportspoll/

Q1. Which of the following statements best describes you?

*Note: Presented in each table Avid + Casual = total sports fandom in the data. Some tables break out the Avid and Casual segments.

Q9. Within your household, including all members of the household, which, if any, of the following media services does the household have a PAID subscription for? Check all that apply.

Q11a. Have you ever subscribed to a streaming service for the sole purpose of streaming a sports game?

Q11b. Did you stay subscribed to this streaming service for longer than 3 months?

Q10. Within your household, including all members of the household, which, if any of the following FREE media services does the household use? Please check all that apply.