Consumers are facing uncertainty surrounding their weekly trip to the market even as the debate over who should set the price ceiling on farm products has been settled.

The price control bill that Congress passed on Jan. 26 gives Price Administrator Leon Henderson price-fixing power, to the chagrin of Secretary of Agriculture Claude R. Wickard, who felt that the the government should not regulate agriculture prices.

“The best protection the consumer has against skyrocketing prices and rationing is abundant supplies and not price decrees,” Wickard argued against the price control bill.

The price control bill will give Henderson and the Office of Price Administration (OPA) sole authority to set price ceilings on common consumer products for the purpose of keeping inflation, and as a result the cost of living, in control. Given how much harm deflation caused the American economy during the 1930s, preventing wild fluctuations in prices is a prime concern of the government.

Up until this price bill, the OPA hadn’t gotten involved with retail prices, but as rationing becomes more and more necessary, price control has become increasingly important.

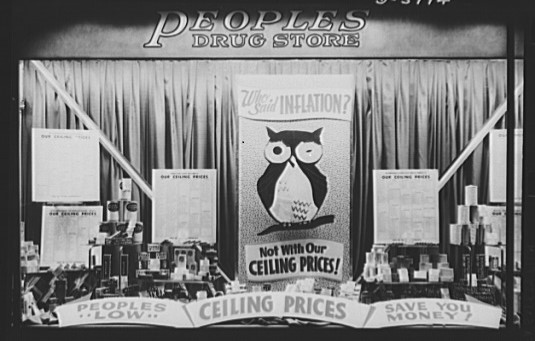

A drugstore advertises its compliance with government-imposed price ceilings. From Library of Congress.

While the price bill will be enforcing a ceiling price on certain items such as sugar and cotton, the government has noted that these are merely maximum prices, meaning the retail price of these items could be lower.

Food and clothing will likely be the first items affected. While the bill was passed for the purpose of keeping prices down, the prices of some farm products are due for a steep rise first because the “four-pronged system,” indicating that farm product price ceilings must not be below 110 percent parity. That means the price ceiling must be 10 percent higher than the market price on Oct. 1 or Dec. 1 of last year, or the average price of the item between 1919 and 1929—whichever figure is highest.

For example, consumers will potentially see corn prices rise 50 percent to $1.02 per bushel. Raw sugar, currently priced at $3.50 per pound, will rise in price as well because its average price between 1919 and 1929 was $4.70 per pound.

In many cases, this new bill will make prices must go up, reaching average or even record highs before they can be regulated or brought down, leaving consumers uncertain about the future of their food staples.

A price spike might lead to a consumer buying spree; a buying spree will likely lead to a ration. As a result, companies such as Canada Dry ginger ale, whose production relies on the availability of sugar for production, could begin to struggle.

Wilfred King, vice president in charge of radio at J.M. Mathes, Inc., the advertising agency for Canada Dry, said that the sugar situation makes it “not only impracticable but almost impossible for our client to function except in a very limited fashion.”

The price bill also specifies that rents in defense areas will be subject to a price ceiling, but the exact ceiling will usually be determined on a local level. President Franklin D. Roosevelt predicted that efforts to fix the sky-high rent prices in certain areas would be high on Henderson’s list of actions to take.

President Roosevelt declared that the bill is not perfect, but it is “workable” and “an important weapon in our armory against the onslaught of the Axis powers.”

“Nothing could better serve the purposes of our enemies than that we should become the victims of inflation,” Roosevelt said.

Sources:

Trussell, C.P.“President calls in House conferees on price curb bill.” New York Times. January 13, 1942, Page 1.

Neal, Fred Warner. “Retail ceilings next; clothing, food chief items to be affected.” Wall Street Journal. January 24, 1942, Page 1, 2.

Albright, Robert C. “House passes Price Control Bill, 286-112.” The Washington Post. January 27, 1942, Page 1.

Friendly, Alfred. “Price Control Act ‘Workable,’ Roosevelt Says.” The Washington Post. January 31, 1942, Page 1, 11.

“Canada Dry to Stop ‘Spur’ Radio Program.” Wall Street Journal. January 21, 1942, pg. 16.