Tax Cut and Job Act of 2017

By Kaitlin Principato

Staff Writer

On December 22, President Donald Trump signed the Tax Cut and Job Act of 2017, which will become effective starting in 2018. Reactions from both political figures and economic analysts have been mixed in nature, misleading many citizens in developing an informed opinion.

According to The Hill, one of the most impactful aspects of the bill is a new reform that will cut top corporate tax rates from 35 percent to 21 percent. Some of the large corporations who have already expressed their benefits from this bill are Disney, JP Morgan, Starbucks, Bank of America, Home Depot, Walmart, and Apple.

Due to the tax cuts, foreign businesses should be more inclined to invest money back into the United States, creating a boost in employment and the overall economy. As reported by The Washington Post, Blackstone chief executive Steve Schwarzman claimed, “There are companies all around the world who are looking at the U.S. now and saying, ‘This is the place to be in the developed world.”

Same companies that once criticized President Trump are now praising him on the tax reform that will save their companies millions. In August, The Washington Post quoted JPMorgan CEO Jamie Dimon as criticizing Trump’s leadership. Dimon said he “Strongly disagree[s] with President Trump’s reaction to the events that took place in Charlottesville over the past several days,” elaborating that “Racism, intolerance and violence are always wrong.” Nonetheless, last week Dimon released a letter praising Trump’s tax bill as having “a significant positive outcome for the country.”

Starbucks, one company that has publically spoken out about the reform, has announced they will be granting stocks in the amount of $500 to employees and $2,000 to managers, reported by The Hill. National Republican Senatorial Committee (NRSC) spokeswoman Caitlin Gallagher said in a statement, “Starbucks is only the latest example of businesses, both large and small, giving back to hardworking Americans. When the economy wins so do taxpayers, and it’s too bad red state Democrats didn’t support these massively successful tax cuts.”

Apple, a company which has deferred paying taxes on its foreign earnings revealed it will repatriate around $252 billion in cash to the United States, as covered by The New York Times. Prior to the new tax reform, Apple has refrained from transferring money to the U.S. due to the expensive repercussions. The New York Times reports that Apple plans to add 20,000 new jobs (a 24 percent increase), a new U.S. campus, and a $275 billion domestic budget increase. Timothy Cook, Apple’s chief executive, said in statement, “We have a deep sense of responsibility to give back to our country and the people who help make our success possible.”

Although the new tax reform has received a range of positive feedback, some analysts feel the reform lowers taxes on companies who should be paying more overall. As reported by The Washington Post, the new tax bill will add approximately $1 trillion to the $20 trillion debt.

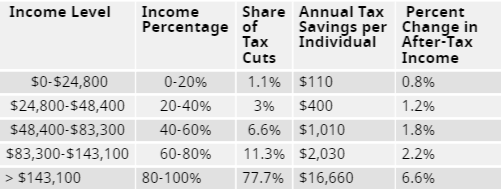

Analysts at Moody’s, one of the big three credit rating agencies, said, “We do not expect a meaningful boost to business investment because U.S. nonfinancial companies will likely prioritize share buybacks. Much of the tax cut for individuals will go to high earners, who are less likely to spend it on current consumption,” according to the Institute On Taxation and Economic Policy. Trump’s new plan is a trickle-down economics 101 theory which has proved to be effective in the past during the Reagan administration; however might not work in today’s economic timing.

Some economists also assume the immediate benefits from the reform will initially go to shareholders over employees. They also claim the corporate announcements on bonuses and raises, such as Starbucks and Apple, are irrelevant to the tax reform success.

Despite the fact that some officials believe the new reform is not as advantageous as described, I believe the lower taxes will result in more investment into American companies, which will be invested into equipment to increase productivity, which will ultimately produce higher wages.