The Federal Reserve’s Rate Hike Campaigns Effect on the U.S. Consumer

Steven Higgins

Staff Writer

U.S. interest rates have hit their highest point since 2007, right before the start of the Great Recession currently sitting at 5.33% (St. Louis FED) and American consumers have been feeling the brunt of it. The spiking cost of everyday goods, record-high mortgage rates, and high fluctuating oil prices have caused the consumer to feel immense financial pain over the past two years. However, some relief may be on the way as all eyes will turn on the Federal Open Market Committee’s (FOMC) next meeting on September 19th as they will decide what the next move will be regarding interest rates. Rumors have already begun to swirl with speculation of a potential pause announcement, though some believe there will be at least one hike before year’s end. This article will break down how the current economic environments, created by the FED’s aggressive rate hikes, have impacted Americans while also analyzing some of the opportunities it has created.

Inflation has caused a dramatic spike in the cost of goods, while wages have struggled to keep up, causing a decrease in the purchasing power of consumers. This issue has been a hot topic for the Federal Reserve as they have employed rate hikes against the highest inflation rates in decades. There was belief that there could be relief on the way as data has shown a continued decline from its peak in June of 2022 (9.1%) as it came in at 3.2% in July of 2023. However, the newly released Consumer Price Index (CPI) data actually showed an uptick in inflation again in August as it rose 0.5% month-over-month. The surprise increase was mainly attributed to a 10.6% increase in gasoline prices in August (CNBC). With inflation at 3.7%, nearly double the FEDS target of 2%, it will be important to monitor the FED’s next rate decision when they meet on September 20th.

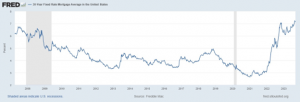

The housing market has arguably been hit the hardest by the rate hikes. The industry has seen a steep drop-off in activity as mortgage rates remain high and continue to rise with rates hitting their highest point since 2007 in early September. 30-year mortgage loans are currently yielding over 7% which has subsequently led to the lowest demand seen in nearly three decades. Mortgage applications in the first week of September dropped a staggering 28% from the same week last year (CNBC). This has caused additional financial hardship for Americans looking to purchase a home, and there does not seem to be much relief in the immediate future.

Investment banking has also felt the effects of the FED’s rate hikes, which has caused a dramatic slowdown in mergers and acquisition activity. Global mergers and acquisitions (M&A) activity fell 36% year-on-year in the second quarter with the total value of M&A falling to $732.82 billion in the second quarter of 2023 from $1.14 trillion in the second quarter of 2022 (Reuters). Analysts have attributed the decline in deals to high interest rates and global uncertainty.

With consumers struggling to keep up with the soaring cost of living, credit card balances shot up by $45 billion between the first and second quarters of 2023, a 4.6% increase that pushed total credit card debt past the $1 trillion mark. Total credit card debt and debt per household also grew by about 8% year-over-year. Additionally, the St. Louis branch of the Federal Reserve shows credit card interest rates have soared to more than 20%, the highest since the Fed began tracking in 1994 (NBC News). The combination of record-high credit card debt and record-high interest on the debt is another clear negative from the rate hikes that consumers will need to find a way to manage amid challenging economic conditions.

The U.S. equity market has been resilient in 2023, despite the FED’s aggressive rate hike campaign, and has provided investors with year-to-date gains across the three major indices. The S&P 500 (15.62% YTD), NASDAQ (30.68% YTD), and DJIA (3.93% YTD) all have seen positive performances coming off a down year in 2022. The bond market has also provided attractive yields for investors with the 2-year treasury (5.097%) and 10-year (4.347%) treasury bonds offering their highest rates since 2007. Money Market funds have also become an enticing investment opportunity to help keep up with inflation as they currently offer 4-5% yields with very low levels of risk. Despite the persistently high cost of goods and economic volatility, there have been lucrative investment opportunities this year.

*YTD data as of 9/19/2023

Contact Steven at higginst@shu.edu