Scarcity in the Housing Market

Payton Costenbader

Staff Writer

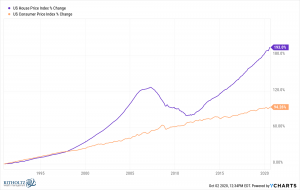

Within recent years the American housing market has experienced various changes that have made finding an affordable home an increasingly difficult process for current buyers. A major issue plaguing the market for all is scarcity. The number of homes available for purchase is down a staggering 18% from just a year ago. Those in older generations, who have already settled into a home years ago, secured low interest rates that are unheard of in today’s market. This creates the “locked-in” effect; homeowners are not moving from their properties, thus keeping houses off the market. Average mortgage rates are up 15% while the average price of a starter home has increased 4.5% in the past year. The unfavorable price tags that come with new properties have driven those who already own their home further into their own estate with no intention of moving.

The idea of purchasing a new home will sound much more appealing when the federal government lowers interest rates and the historically high mortgage rates come down from this dramatic spike. However, while this sounds positive when looking to purchase a new home, it will only worsen the issue of scarcity. Demand will increase as not only are people shopping for their first homes, those looking to move when interest rates are favorable are also entering the already incredibly competitive market. The demand for housing will further increase while the supply of goods, in this case properties, decreases. This combination is the perfect recipe for the cost of houses to begin skyrocketing once again.

It is no secret that the housing market is not currently favorable to those looking to purchase their first home. A third of the population of America is between the ages of 20 and 44, which is the age range in which most are looking to purchase their first home. In addition, this demographic also carries the most student loan debt. In recent years, student loans payments have been paused as part of The Department of Education’s student loan forbearance program. This program provided relief to those struggling to make payments after the Covid-19 Pandemic of 2020, during which many people lost their jobs. The program is rapidly coming to an end as interest payments resumed on September 1st, 2023, and monthly installments are picking up again in October. This is a variable that will add to the difficulties new home buyers will face in 2023. The addition of a monthly student loan bill is pulling budgets even tighter for those looking to purchase their first home.

While student loans are a holdback for some looking to purchase a home, not all people have that debt to concern them in their buying process. There are other factors creating stress in the market that are more widely applicable. While there are external factors limiting the ability for younger generations to purchase homes, for example the student loan stressor, the major factor damaging the market is scarcity. There is an overwhelming demand for houses and simply not enough properties to satisfy that. Looking into the future it does not seem that there will be any major immediate relief in the price of property in the United States.

Contact Payton at costenpa@shu.edu