IRS Adjusts Tax Brackets by 7%

Michael Siehienczuk

Staff Writer

On October 18th, the Internal Revenue Service (IRS) announced the annual inflation adjustments for the 2023 tax year. Many key tax provisions, including the income thresholds for the federal tax brackets, will increase by about 7% to account for the high inflation Americans have seen throughout 2022. This big adjustment could mean many folks could stay in a lower tax bracket and some may even see a smaller tax bill in 2024. It will help increase the paychecks of many by taxing more of their earnings at lower rates.

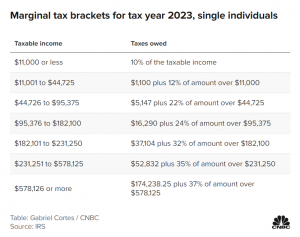

The individual federal tax brackets have been automatically indexed for inflation since 1985—a provision that was passed in 1981 after going through a period of inflation that was even higher than what the country is now experiencing (Forbes). There are seven different federal income tax rates at which earned income is taxed: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

The top income tax rate of 37% will apply to individuals earning $578,125 — or $693,750 for married couples who file joint returns. That is up from $539,900 for individuals this year. The difference being $40,000 worth of individual income is eligible to be taxed next year at a lower rate of 35%. This is being applied to every single tax rate as the income qualifications for a 10% tax rate increased from $10,275 to now $11,000. These tax bracket adjustments will help Americans qualify for lower tax rates even if they have a higher income.

The new tax brackets are not the only tax provision changed by the IRS’s annual inflation adjustments. These adjustments have also led to a larger standard deduction for 2023. The standard deduction helps reduce a taxpayer’s taxable income by making sure that only households with income above certain thresholds will owe any income tax. The standard deduction for single taxpayers and married individuals filing separately rises to $13,850 for 2023. That is up $900 from 2022’s $12,950 standard deduction (Forbes). For married couples filing jointly, the standard deduction climbs to $27,700, a $1,800 increase from 2022.

Even with the economy struggling and inflation at such a high rate, these tax bracket adjustments and increases in the standard deduction will help Americans save money when filing their taxes this upcoming season. The announcement of adjustments is a yearly occurrence, but in a year of exceedingly high inflation, the move to raise the standard deduction and income thresholds where tax rates take effect may mean savings for people in all income brackets.

Contact Michael at michael.siehienczuk@student.shu.edu