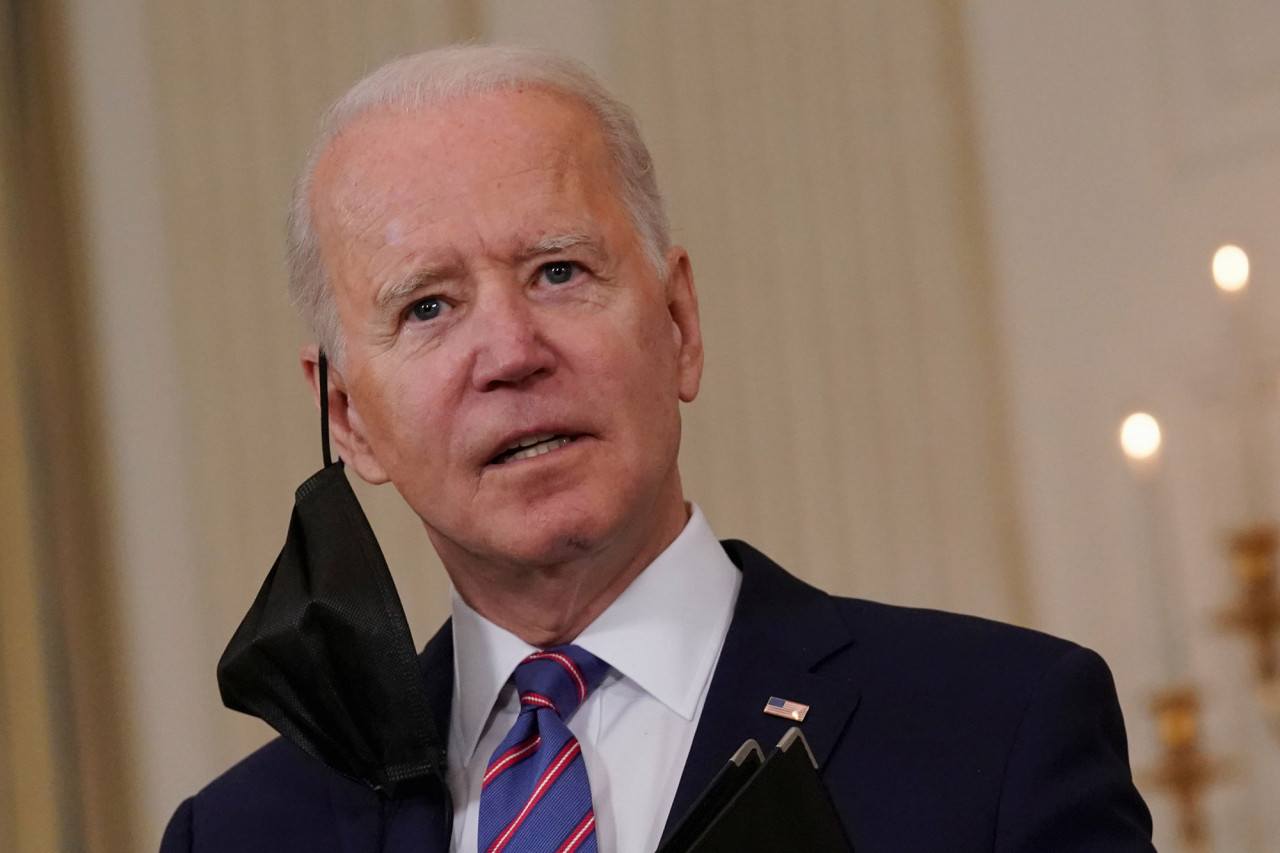

President Biden Proposes Raising the Corporate Tax Rate to 28%

To fund his $2 trillion infrastructure plan, President Joe Biden has proposed to raise the corporate tax to 28%. According to the New York Times, corporations will be required to pay fifteen years of taxes at the 28% rate. This is an increase from President Trump’s previous tax cuts, which decreased the corporate tax from 35% to 21%. Not all companies will be taxed the same amount, however.

Read More