Implications of Chip Shortages

Jason Lyons

Staff Writer

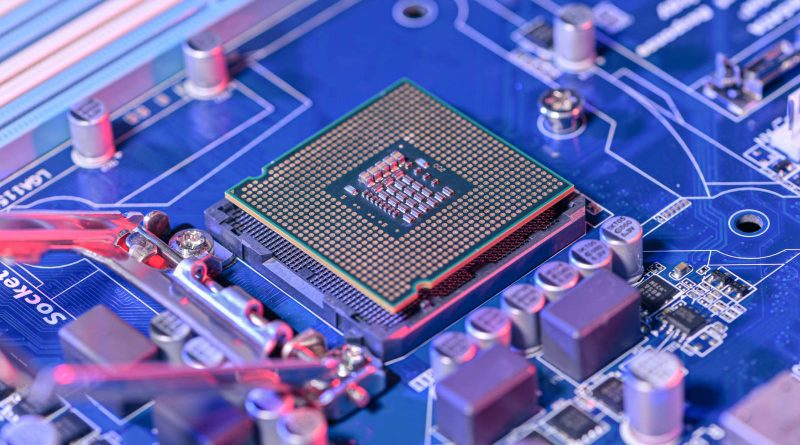

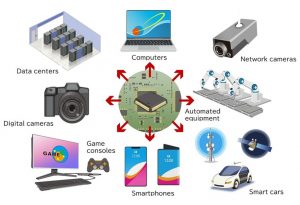

As technology becomes increasingly integrated within our everyday products, demand for semiconductors has outpaced supply, and this constraint has worsened under COVID-19. Semiconductors, or “chips,” are typically made of silicon and conduct electricity in products, such as computers, smartphones, automobiles, medical equipment, and kitchen appliances.

Silicon production, a key component also in medical equipment, was shifted away from semis and to the healthcare sector in 2020, further constraining the supply of chip manufacturing. The laws of supply and demand teach us that a decrease in supply and increase in demand lead to an increase in prices. The Semiconductor Industry Association (SIA) reported 2021 global semis sales reached a record $555.9 billion, up 26.2% year over year increase. SIA forecasts double digit growth through 2023, followed by moderate growth as supply bottlenecks ease.

The automobile industry has been the hardest hit by the chip shortage. Automakers rely on Just-in-time (JIT) supply chains, meaning parts are ordered as needed to minimize the holding period for inventory. During the initial COVID lockdowns, car manufacturers canceled chip orders, anticipating a decrease in sales.

Semi manufacturers, such as Taiwan Semiconductor’s, shifted to industries that spiked during the pandemic with people working remotely, from 5G phones to computers so employees can use Zoom Inc. for remote meetings. This resulted in car manufacturers cutting vehicle production, negatively affecting workers as they are laid off and the companies’ top and bottom lines. Nissan and Ram announced cutting back on high end features that require semis, including digital screens and rear cameras, according to CNBC. Rising prices are passed onto consumers, as US Bureau of Labor Statistics reports a 40.5% year over year increase in used car prices from January 2021 to 2022. For reference, January CPI data showed a 7.5% jump. Consumer quality of life may stagnate with prolonged use of older products as new technology is in short supply or is no longer affordable.

Governments are also calling for semis to be produced domestically to ease the supply chain, reshoring jobs from East Asia back to the United States. For example, Intel recently announced a new factory in Ohio, and Samsung will be constructing a new factory in Texas. Contingency plans of companies hit by the shortage may have multiple suppliers, creating opportunity for Nvidia, AMD, Micron, and Texas Instruments. FAANG companies like Apple have already shifted away from chip suppliers to develop their in-house chips.

Economists, semiconductor companies and car makers all forecast the chip shortage to continue throughout 2022 and into 2023. Construction of new plants will increase output in the long term, however an increase to semiconductor supply is needed now.

Contact Jason at jason.lyons@student.shu.edu