Severe Turbulence: Inside Boeing’s Recent Struggles

Justin Kwok

Staff Writer

Boeing, a giant in the aviation industry, finds itself in the spotlight due to recent controversies. On Friday, January 5th, an Alaska Airlines Boeing 737 Max 9 jet, which carried 171 passengers and 6 crew members, experienced an emergency landing in Portland, Oregon. Fortunately, there were no serious injuries, but the incident has been the cause of negative attention for Boeing. Boeing is known as a leader in the aviation industry, as they develop, manufacture, and service commercial airplanes along with defense products on a worldwide scale. Alaska Airlines, American Airlines, United Airlines, and Southwest Airlines all own Boeing 737 Max 9s. During the flight, a section of the aircraft’s wall fell off, which left a gaping hole and warranted an immediate grounding of the Alaska Airlines flight 1282.

The emergency landing not only gained lots of media attention, but also attracted the interest of the Federal Aviation Administration (FAA). The FAA oversees the manufacturing, operation, and maintenance of aircraft by issuing and enforcing regulations to create a safe and efficient airspace experience. The FAA ordered the grounding of many 737s, with approximately 171 of them belonging to Alaska Airlines. After the incident, the FAA announced immediate inspection and audit on certain 737 Max 9s before they return to flight.

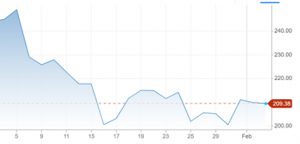

Boeing stock closed at $249.00 on January 5th, the day of the incident, and fell to a low of $200.52 on January 16th, nearly a 20% drop and wiping off tens of billions of dollars of Boeing’s market capitalization. The stock still trades well below pre-pandemic levels by nearly 30%.

Ben Minicucci, Alaska Airlines CEO, announced in an interview with NBC News that they found many loose bolts on the 737 Max 9 planes after the grounding incident. In the interview, he expressed his thoughts, saying “I’m more than frustrated and disappointed. I am angry. This happened to Alaska Airlines. It happened to our guests and happened to our people. And – my demand on Boeing is what are they going to do to improve their quality programs in-house.” His demands for an improvement in quality control were clear, and certainly warranted. The airline is also seeking $150 million in compensation for the grounding, which includes refunds, accommodation costs, and a $1,500 fee per passenger on the flight. Passengers on the flight have also filed two separate lawsuits against both Boeing and Alaska Airlines due to physical and emotional distress resulting from the incident. United Airlines also announced that they discovered loose bolts on their Max 9 planes, and as a result are suspending service of their Max 9 jets.

Boeing has had a history of struggle, with a repeated theme of safety issues and lacking quality. In October of 2018, a 737 Max was involved in a fatal crash in Indonesia, and again a little over a year later in Ethiopia in March of 2019. These two crashes were responsible for the tragic loss of 346 lives. Quality issues also plagued the 787 Dreamliner, another one of Boeing’s jets, as it was ordered for grounding in 2021 and again in 2023 as the FAA expressed their concerns. A 777 jet was also ordered for grounding due to an engine failure. Boeing has had their fair share of issues in the past, and the Alaska Airlines incident has further heightened concerns about the safety of Boeing jets.

Boeing did not provide guidance for 2024 during their quarterly earnings report on Wednesday, January 31. They reported beats in revenue, net income, EPS, net profit margin, operating income, and cost of revenue, but chose not to provide financial targets for the upcoming year as CEO Dave Calhoun said, “We will simply focus on every next airplane.” The clear focus was not solely on financial results from the previous quarter, but rather the overarching picture of Boeing’s response to recent struggles and approach on improving their quality control and production to develop safe and efficient planes. Boeing shares rose 5% in afternoon trading after the earnings report. Many investors had concerns about the efforts to improve the manufacturing process as it could slow plane delivery and be more costly, along with the fact that many airlines rely on Boeing’s jets and have expressed their concerns with the manufacturer. On January 24, the FAA cleared Boeing to resume flight for their Max 9 jets, but halted production expansion of the aircraft in an effort to control the quality of planes being produced.

So what’s next for the airplane manufacturer? Boeing has fallen behind Airbus, a main competitor in the aviation industry. Delta Airlines, one of Wall Street’s favorite airline stocks with a 96% buy rating among analysts, is also limited in exposure to Boeing in comparison to the other major U.S. airlines, which is a symbol of the diminishing trust in Boeing jets. To regain market share, many have suggested the idea of introducing a new plane that is clear of issues as opposed to the tarnished 737, which was introduced in 1968. Unfortunately, an announcement of a new plane would take many years to be certified for service and cost billions to develop. FAA oversight also makes the introduction of a new plane more challenging. Despite these challenges, a completely new plane may provide a clean sheet for Boeing and help rebuild their reputation.

A solution to improving quality and production is removing their “shadow factories,” which are the factories where Boeing reworks the 737 Max and 787 jets. The removal of these shadow factories would help lower costs and provide an open door to ending the painful issues of the past by developing a better system for maintaining their jets. The idea here is to create a better-quality control system when the planes are manufactured and avoid any issues to start rather than spending most of their time and money reworking the planes, when the shadow factory strategy has been proven to be unsuccessful.

Overall, the future of Boeing is uncertain, but one thing is known. If they want to rebound and re-establish themselves as the king of aviation, they must take additional measures in ensuring safety and quality in their products to avoid future turbulence.

Contact Justin at justin.kwok@student.shu.edu