Macy’s: Salvageable Retail Titan or Real Estate Goldmine?

Johannes Sasse

Staff Writter

This past week, Macy’s received a $5.8 billion offer from two private equity firms to privatize the retail giant. Arkhouse Management, specializing in real estate investments, and Brigade Capital Management, a global asset manager, have collectively valued the department store chain. Their offer to take the company private stands at around $21 per share, reflecting a 21% premium from Friday, December 8th’s closing price of $17. This proposal signifies the investor group’s belief that Macy’s is undervalued in the public market.

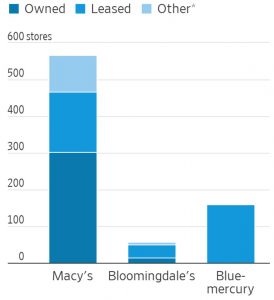

Macy’s, a department store giant, operates over 508 owned stores along with Bloomingdales (85 stores) and Blue Mercury (177 stores), employing around 94,570 people across the US. A prime-time example of the American department store culture of the 2000s, Macy’s has faced a decline in popularity and has lagged behind in the online retail sector. The past year hasn’t been kind to Macy’s, witnessing a continued decline in stock prices since 2015, plummeting by 75% from $73. Over the past eight years, Macy’s has closed nearly 300 stores—around a third of its total locations—resulting in a loss of $3 billion in annual sales. However, Macy’s stands out favorably among brick-and-mortar stores like Kohl’s or Nordstrom due to its healthier balance sheet, with a net debt to earnings ratio of 2.7. It also managed to significantly reduce its long-term debt from $7 billion in 2017 to $3 billion in 2023.

In Q2, Macy’s saw an 8% year-over-year sales drop to $5.13 billion, with both brick-and-mortar and online revenue taking a hit—a trend reflecting a decade-long struggle with shifting consumer habits and new competition. Over the past two decades, department store retail sales have halved, according to the Census Bureau, mirroring the evolving consumer preference for online shopping and alternative retail choices.

Positioned amidst luxury retailers and discount chains, Macy’s faces pressure from both ends of the retail spectrum. Meanwhile, the surge of direct-to-consumer online fashion brands propelled by social media platforms, like Instagram and TikTok, alongside the expansion of retail giants such as Target, Walmart, and Costco offering products that were traditionally offered by department stores, has further intensified the competitive landscape. This includes the encroachment of fast-fashion giants like H&M, Uniqlo, Shein, Temu, and the growth of discount apparel outlets like TJ Maxx and Burlington, all competing for market share.

In recent years, investor groups, such as private equity and hedge funds, have actively acquired struggling retailers to privatize, streamline operations, and sell for profit. Kohl’s faces pressure from activist investors and declining sales, while J.C. Penney recovered from bankruptcy with support from mall owners. Luxury retailers Saks Fifth Avenue and Neiman Marcus are considering a merger amidst a downturn in luxury goods sales. Sears, under hedge-fund manager Eddie Lampert, declared bankruptcy in 2018 after selling off real estate without adequately reinvesting in retail. Currently, Sears operates a small percentage of stores compared to its previous widespread presence. Dillard’s, led by its founding family, stands out as a thriving exception.

A potential Macy’s acquisition might not end well for its retail segment, as the company’s true value may lie in its real estate holdings. Macy’s has previously attracted investor interest for its property assets. In 2015, Starboard estimated Macy’s properties at $21 billion, with the Herald Square store alone valued at $4 billion. Subsequently, in 2017, Hudson’s Bay valued Macy’s at $14 billion. Macy’s resisted pressure from investors fixated on its real estate, who advocated for selling it off. This approach would have required leasing back the locations, incurring debt-like payments. To navigate this, Macy’s sold certain properties (like a San Francisco store) and partnered with real estate firms to unlock value at other locations.

Neil Saunders, GlobalData Retail’s managing director, values Macy’s property at approximately $6 billion, exceeding its market capitalization by $1.2 billion. According to Oliver Chen of TD Cowen, the Herald Square property alone contributes roughly a fifth of Macy’s real estate value. An acquisition of Macy’s might prioritize leveraging its real estate, potentially involving partial selloffs to unlock its value. However, such a move could exemplify typical private equity strategies involving significant cost reductions or partial spin-offs. Saunders highlighted to the Wall Street Journal that while selling off real estate and other actions could yield short-term gains for investors, neglecting reinvestment in the core retail business might leave Macy’s in a challenging position in the long run.

The offer to privatize Macy’s by Arkhouse Management and Brigade Capital Management arrives at the tail end of some of the retail giant’s most challenging years. Yet, if this transition goes through, caution is crucial to avoid mirroring the Sears downfall—a scenario where emphasis on real estate overshadowed core retail operations, leading to bankruptcy. It will be interesting whether shareholders will accept the $21 per share offer or if the price will increase, potentially leading to a failed deal. As we look to the future, consumers and investors alike should keep an eye on speculation about post-acquisition strategies and potential price movements, setting the stage for an intriguing and uncertain future.

Contact Johannes at sassejoh@shu.edu

Great article! I like how it delves about valuable insights into the potential future of Macy’s and the dynamics of the retail industry. It prompts reflection on the balance between real estate and core retail operations, as well as the evolving landscape of department store culture. The offer’s implications for Macy’s, its employees, and the broader retail sector make it a great and compelling topic for further analysis and discussion.