Hess Acquisition Adds to Shifting Energy Market

Robert Lussier

Staff Writer

The energy sector this past quarter has had an M&A party, and these developments have captured the attention of investors and analysts alike. The events of 2022 shook the world and energy markets. The invasion of Ukraine and its political ramifications resulted in severe dislocations in energy markets, thereby ensuring that energy, especially its availability and affordability, remained at the forefront of sociopolitical debate. One of the immediate effects of these geopolitical tensions has been a surge in energy prices, resulting in oil companies accumulating substantial cash reserves on their balance sheets. With this financial cushion in place, oil companies are now in a favorable position to consider strategic investments in new and potentially lucrative ventures.

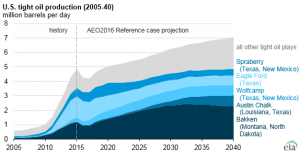

The biggest energy company in the world, ExxonMobil has entered a merger with Pioneer Natural Resources in an all-stock transaction valued at nearly $60 billion. This probably stems from Chevron moving forward with an acquisition of Hess in an all-stock transaction valued at $53 billion. The acquisition of Hess will increase Chevron’s shale production by 1.3 million barrels per day (40%), leveling the playing field with Exxon’s anticipated shale production. Shale oil production is an unconventional method of oil production that involves extracting hydrocarbons found in tight shale rock from the earth, bringing it up to the surface. Hess Corporation, a prominent American independent energy company, has been actively involved in shale oil production in various regions of the United States and the rest of the world.

Acquisitions like these by American oil companies are part of a strategy to leave European companies in the dust on the fossil fuel front. European companies are investing in renewables, but the Americans are hedging that renewable energy does not yet have the highest net present value as an investment and are allocating future equity to their bread-and-butter fossil fuel production. It will be interesting to see how in the future this venture will affect these company’s financial profile. All in all, the energy sector’s M&A activities are indicative of the sector’s response to the geopolitical turbulence of 2022. As industry giants like ExxonMobil and Chevron engage in strategic mergers and acquisitions, the future of the energy sector appears dynamic and full of potential transformations. It’s a space worth watching closely as these developments unfold and shape the sector’s landscape.

Contact Robert at lussierro@shu.edu