What the Fed Had to Say: September FOMC Meeting

Justin Kwok

Staff Writter

On Wednesday, September 20, investors eagerly awaited the highly anticipated Federal Open Markets Committee (FOMC) meeting, where Jerome Powell of the Federal Reserve (The Fed), and his team made a pivotal decision to hold interest rates steady, with the current federal funds target rate sitting at 5.25%-5.50%, representing a 22-year high.

This decision came after the preceding FOMC meeting in July, where the committee decided to raise their target for the federal funds rate by 25 basis points. The federal funds rate is the interest rate in which banks and other depository institutions can lend their reserve balances to other institutions overnight, which affects mortgage rates, loans, CDs, savings account rates, and more. Now, the Fed decided to pause interest rate hikes but left the possibility of another rate hike later this year remaining on the table. Economists are expecting interest rates to stay at their current levels through most of next year and concluding 2024 with the federal funds rate hovering around 5%. This projection would imply two 25 basis point cuts to end 2024, with the assumption that one more 25 basis point hike is implemented this year.

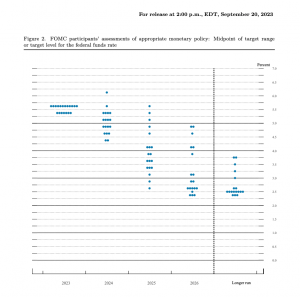

A major point of emphasis going into the meeting was looking for any indication as to when the Fed would begin cutting these historically high interest rates. Investors had their eyes on the Fed’s dot plot, which shows where different FOMC members see interest rates reaching in the next couple years. This was found in the SEP, or Summary of Economic Projections, which is released 4 times a year. Of the 19 Fed officials, 12 were in favor of another rate hike this year, either in the October 31-November 1 meeting or in December. The results from the dot plot show a hawkish perspective from the Fed, that they feel the job is not finished and a more restrictive stance must be taken.

The Fed has been actively combatting inflation, which reached 40-year highs in 2022. The hope of the Fed is to raise the federal funds target rate to slow down economic growth. Beginning in March of 2022, the Fed began to implement their monetary policy of raising the target rate to bring inflation back to normal levels. Chair Powell had strong emphasis on the phrase “proceed carefully,” as he mentioned 6 times throughout the conference. This shows that the Fed is taking a cautious approach while still being restrictive.

Inflation slowed down where in August 2023, the consumer price index, or CPI, grew 3.7%, aligning with expectations. CPI measures a change in price over time for a basket of consumer goods. Core inflation sat at 4.3%, which is down from 4.7% in July. Core inflation measures a change in price of goods and services, excluding food and energy prices which are more subjective to volatility. The Fed has a target core inflation rate of 2%, and they have been employing monetary policy by increasing the federal funds target rate in order to curb inflation and moderate economic growth.

The labor market added 187,000 jobs in August, which surpassed economist expectations of 170,000. The labor market has been tight, but started to cool down as unemployment rose to 3.8%, which is the highest level since February 2022. The Fed is hopeful that this cooldown in job hirings, due to higher interest rates, will be successful in lowering inflation.

Many investors are hoping for a “soft-landing” following the resilient economic growth the U.S. has seen over the past few years. This can be a tough task for the Fed, as they have to think about both the need to lower inflation, and the potential for a recession caused by dramatic rate hikes. Fed Chairman Powell said the supply and demand conditions of the labor market have come into better balance, which will help ease the pressure of inflation. On the flip side, he also mentioned that the U.S. is not out of the woods yet and a recession is still a possibility. The Fed will continue to evaluate economic conditions before their October 31 meeting as investors keep their eyes on a potential policy decision, with the current bets being placed that they will indeed implement one more 25 basis point rate hike before the end of the year.

Contact Justin at justin.kwok@student.shu.edu