Navigating the Shifting Tides: An Analysis of the Evolving Labor Market

Mark Walier

Staff Writer

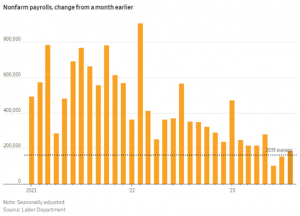

Over the last several weeks, we have seen the demand for workers cool, and job creation ease, as the labor market trends have been reverting to pre-pandemic levels. This shift marks yet another turn in the U.S. labor market, which has seen unprecedented volatility in the wake of the COVID-19 pandemic.

In the early stages of the pandemic, unemployment rates soared. When businesses began reopening, companies found themselves in a desperate search for workers. However, the labor force didn’t exhibit the same eagerness for work as it did before the pandemic. In April 2020, the labor participation rate hit a low of 60.1%, marking the emergence of the pandemic phenomenon known as “The Great Resignation.” Consequently, job openings reached historic highs as power dynamics shifted from the employers to employees. Recently, we have witnessed a reversal of this trend as the labor market loosens and worker competition diminishes.

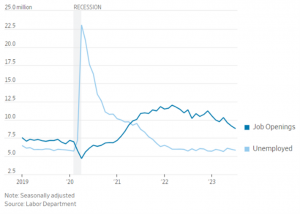

Just a few months ago, U.S. job openings reached a peak of 12 million in March 2022, approximately double the number of unemployed individuals. Over the summer, we witnessed a decline in demand, with job openings in August totaling 8.8 million compared to 5.5 million unemployed individuals. Similarly, the quits rate, which calculates the number of job resignations as a percentage of total employment, dropped to 2.3% in July from its recent high of 3% in April 2022. This decrease suggests that workers may be feeling less confident about finding another job with equal or higher pay. These trends, including the narrowing gap between job openings and unemployed individuals, suggest a softening of the U.S. job market.

The shift in the labor market environment has been primarily driven by the Federal Reserve’s actions, including its aggressive interest rate hike policy targeted at combatting inflation and slowing the economy. Two weeks ago, Federal Reserve Chair Jerome Powell indicated that the Fed might maintain current rates at September’s policy meeting but could consider raising them later this year if economic data remains robust. August’s CPI increased 3.7% YoY (year-over-year) compared with July’s 3.2% YoY growth, potentially complicating the Fed’s efforts to achieve a “soft landing”. Additionally, wage growth is cooling as employers encounter reduced competition for workers and more individuals rejoin the labor force. As interest rates remain elevated due to the Federal Reserve’s anti-inflationary measures, signs of weakness in the labor market are becoming increasingly apparent.

Nevertheless, the labor market continues to operate at historically elevated levels. In August, the U.S. unemployment stood at 3.8%, with the addition of 187,000 jobs. Furthermore, there is an approximate surplus of 3.3 million workers when comparing job openings compared to unemployed individuals. Relative to pre-pandemic levels, these metrics indicate that the U.S. labor market still possesses resilience.

Contact Mark at walierma@shu.edu