Income Inequality on the Rise

Jessica Moran

Trending Editor

Despite unemployment being at historic lows and job growth being through the roof all prior to the coronavirus pandemic, wage growth had not seen such improvements during that same stretch of economic greatness. The United States’ real average wage has the same purchasing power that it had about 40 years ago— this is appalling and has led to growing consideration of increasing the federal minimum wage.

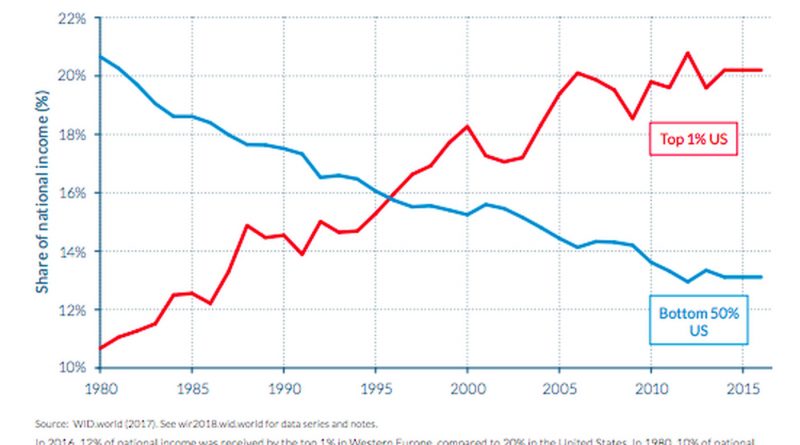

During high inflation years, wages typically increased by seven to nine percent, but now they are only increasing by around three percent. Thus, after adjusting for inflation, consumer purchasing power has not changed by much at all— in fact, it is the same as it was in 1978. Despite not including other benefits, like health insurance and retirement contributions, these increases are very small considering wages and salaries make up the largest component of compensation. The same trend can be seen when analyzing the usual weekly earnings of full-time salary workers in that their weekly earnings have not changed much. However, the wages of the highest earners have seen considerable increases. Their wages have increased a cumulative 15.7%.

The failure of wages to grow and the rising wage inequality should cause concern for many. Low- and middle-class Americans should be very concerned as they have experienced the lowest percent increases in wages over the last generation. This slowed growth is due to not only the rising cost of benefits, like employer-provided health insurance, but also due to a series of poor international policy decisions. Policy makers have been making decisions on behalf of those with high income and political power. Many have abandoned the idea of full employment as a main objective of economic policy making and have allowed CEOs to reap most of the gains of economic growth. Thus, these policy decisions have shifted economic power away from low- and middle-class workers and toward corporate managers.

All these decisions have caused large gaps between the social classes in the United States. For example, according to the Pew Research Center, “Americans in the top tenth of the income distribution earned 8.7 times as much as Americans in the bottom tenth ($109,578 versus $12,523).” Another factor is that the implementation of technology, like artificial intelligence, has eliminated many mid-level positions. This “corporate flattening” has caused companies to invest in automation rather than investing the money in its workers.

All in all, stagnate and uneven wage growth is never a good sign, and is certainly widening income inequality in the United States. But it might just be as simple as a long-lasting post-2008 recession reaction— Managers across the country might not be ready to increase the wage rate in fear of another recession, which has been exacerbated by and come in the form of the coronavirus.

Contact Jessica at moranjes@shu.edu