Blockchain Demystified: The Future of Financial Transactions?

Mark DiPietro

Technology Editor

We are in a booming age of technology. Five billion people currently use the internet creating about 400 exabytes of data and, by 2030, it is projected that there will be about 500 billion individual devices connected to the internet. Needless to say, there are lots of new technologies on the horizon.

Amongst the most exciting of these new technologies is a payment processing model called Blockchain. While the structure and ideas of Blockchain have been around since 1993, the term has catapulted into modern linguistics ever since it was adopted by Bitcoin in 2009 to exchange its units. Some view crypto as an extremely risky investment. In financial terms, this is certainly merited. The price of any cryptocurrency shoots up and down seemingly at random and the recent FTX meltdown proves that the firms that pedal these currencies are extremely volatile. But what often is overlooked is that while the financial aspects of crypto as investments are fallible, the technological system that a coin like Bitcoin is built off of is largely considered more stable and cheaper than the third-party transaction information system that are traditionally performed by banks. This is thanks to this concept of Blockchain, which is relatively complex, but the basics can be simplified in basic terms.

The most fundamentally stable thing about the concept is the very structure of the chains, which demand integrity to be usable. Each block in the chain contains a few key elements. First, the data related to the transaction such as who, what, when, or how much. The block also contains a specific identifier called a hash as well as the hash of the previous block that it was connected to. This hash is directly tied to the components of the data. So, if anyone was to try and change the data it would break the chain of any preceding block since the block’s hash and the next block’s stored “previous block” hash would no longer match.

However, it would still be theoretically possible for a chain to be hacked and changed if Blockchain had only this layer of security since skilled hackers could change something in one block and then change every related block to make sure it was still a valid chain. After all, it would just be changing amounts and dates, right? That is why every block must also have something called a proof-of-work, or a unique, complex code that proves every aspect of the block’s data. This is specifically designed to slow down the creation of blocks of data as a proof-of-work takes at least 10 minutes to create. When chains have hundreds, thousands, or millions of blocks it would be incredibly time consuming to try and change a chain.

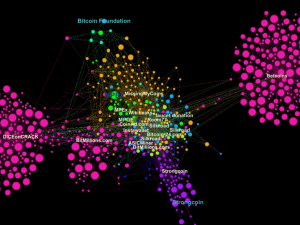

These two layers of integrity make disturbing the integrity of any given transaction a difficult task. But, a third layer of protection also acts as a deterrent to malfeasance, decentralization. The chain is set up as a public, distributed ledger that compiles transactions across multiple accounts.

A natural critique would be, “how can users ensure the integrity of the system, wouldn’t that make the system vulnerable without a governing body?” When considering this question, it is important to understand that the integrity is not being ensured by some users. The integrity is being ensured by all users. That is to say that no transaction will be validated unless there is consensus amongst all copies of the distributed chain. This overall structure is referred to as a decentralized structure, meaning no single organization is managing the integrity of the chains like a traditional financial institution. Instead, it is being managed by the users of the system.

Because of this need for consensus, a potential bad actor would not only have to penetrate the first two layers but also repeat this process and control over 51% of versions in the chain. In some less popular Blockchains, it may be easier to do this. But, for a currency like Bitcoin, there are almost 70 million unique wallet holders, making this task virtually impossible.

With the rise of any revolutionary technology comes fear. Our hesitance to this change is a natural, human reaction that has kept us safe throughout the generations. But, we must resist dismissing all of the unknown as automatically dangerous. Blockchain has been proven in a limited sample size to provide unprecedented safety and stability that traditional money transfers could not dream of. While everyone should keep a healthy skepticism towards new technology, everyone should also keep a close eye on the Blockchain because it might become the future of transactions.

Contact Mark at markdipietro04@gmail.com