Revival of U.S. bank IPO’s with Bancompany

Daniel Kassim

Staff Writer

Bank IPOs are back. Sort of.

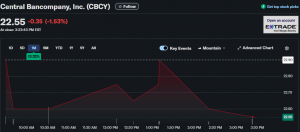

Central Bancompany announced late last week it targets a valuation up to $5.72 billion in its U.S. initial public offering. The Jefferson City, Missouri-based lender plans to raise as much as $426.7 million by offering 17.8 million shares priced between $21 and $24 each.

This matters because you rarely see U.S. banks go public anymore.

Commercial Bancgroup Broke the Ice in October

Commercial Bancgroup went public on October 2nd, pricing its upsized IPO at $24 per share and raising $172 million. The Tennessee-based community bank operates at 34 branches across Kentucky, North Carolina, and Tennessee.

It was priced below expectations, between $25.75 and $27.75. A clear message was sent to investors who wanted a discount.

On its first trading day, Commercial Bancgroup opened at $25.25 but closed flat at its IPO price of $24. The stock was unable to gain much traction in early trading.

Today, the stock changes hands at around $25, a skimpy 4% above its offering price, more than a month later. That’s not quite a ringing endorsement. When an IPO barely budges after its debut, it is a sign of lukewarm investor demand.

That makes Central Bancompany only the second traditional bank IPO this year.

Why Bank IPOs Dried Up

Few U.S. banks have been willing to go public since the 2008 financial crisis, as tougher oversight, higher compliance costs and market turbulence cut the allure of public listings. The regulatory burden alone tends to make going public a tough sell for most regional lenders.

Think about it: After 2008, regulators slammed the door shut on risky behavior. That means more paperwork, higher costs, and constant scrutiny. Most banks decided private ownership looked pretty good by comparison.

The October Government Shutdown Threw a Wrench

Timing has been brutal for IPO hopefuls. A government shutdown in October pulled the brakes on appetites for IPOs, hindering activity with short term delays.

As Michael Ashley Schulman, partner and chief investment officer at Running Point Capital, said, “The United States government shutdown took the Securities and Exchange Commission offline at exactly the wrong time, like a DJ walking away mid drop.”

When the SEC goes dark, deals stop. Companies can’t price their offerings. Investors sit in their hands. Everything freezes.

Commercial Bancgroup filed before the shutdown and managed to slip through. But the disruption chilled the market just as Central Bancompany was preparing to launch.

What You Need to Know About Central Bancompany

Central Bancompany has total balance sheet assets of $19.2 billion and wealth assets under the advice of $15.4 billion, serving consumers and businesses in Missouri, Kansas, Oklahoma, Colorado, and Florida.

The group operates through its subsidiary, The Central Trust Bank, offering consumer and commercial banking services, as well as wealth management products. At the end of June 2025, the firm operated 156 full-service branches and was estimated to have a 24% deposit market share across its markets.

The joint lead book running managers for the offering are Morgan Stanley and Keefe, Bruyette & Woods. Central Bancompany plans to list its shares on the Nasdaq Global Select Market under the ticker symbol “CBC”.

That is big league underwriter for a regional bank. Morgan Stanley doesn’t take on small deals.

The Broader IPO Market Shows Signs of Life

U.S. IPO activity rebounded this autumn season, with several big names including Swedish fintech firm Klarna and Winklevoss twins-owned cryptocurrency exchange Gemini commanding strong investor interest in their respective public offerings.

This is just what the IPO market needs. After years of companies remaining private longer, burning through venture capital, the public markets finally look appealing again. Lower interest rates help. So does a stock market near record highs.

Because banks are pulled by different variables than technology firms or crypto exchanges.

What This Means for Regional Banks

“This will be a welcome addition to the pool for banking and finance specialists who have seen it grow smaller through M&A and the occasional bellyflop,” Schulman said.

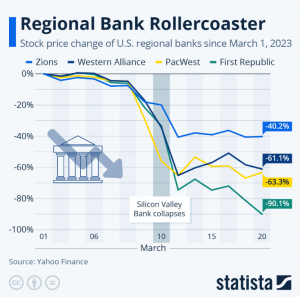

Translation? Investors who focus on financial stocks have had fewer options lately. Mergers and acquisitions have consumed many regional banks over the past decade. Some banks, like Silicon Valley Bank and First Republic, failed spectacularly in 2023.

Central Bancompany’s IPO offers a chance to invest in a traditional regional bank. These institutions make money the old-fashioned way – they take deposits, make loans, and earn the spread between what they pay depositors and what borrowers pay for them.

No fancy crypto trading, no risky venture lending. Just plain vanilla banking in the heartland.

The Real Test Comes After Pricing

Just consider Commercial Bancgroup’s performance. The stock trades just above its IPO price. Investment appetite for regional banks is restrained even in this hot IPO market.

Central Bancompany needs to do better. The company must convince investors that a regional bank based in Missouri deserves a $5.7 billion valuation in a world where interest rates stay high, and commercial real estate remains under pressure.

You should watch how this IPO performs. If it succeeds, expect more regional banks to test the public markets. If it flops, the IPO window slams shut again for banks.

What Happens Next

Assuming there are no more government disruptions, the deal should be priced within the next few weeks. Central Bancompany will either price at the high end of its range depending on market conditions or must cut the valuation.

For now, this IPO is a small step toward the normalization of bank capital markets. But calling it a comeback feels awfully premature. Two bank IPOs don’t make a trend. You need sustained activity over multiple quarters before declaring victory.

The banking industry will be watching closely. So should you.

Contact Daniel at daniel.kassim@student.shu.edu