AI and Compliance: How Financial Institutions Are Buying (and Being Bought) to Stay Ahead of Regulatory and Tech Risk

Sara Kathuria

Staff Writer

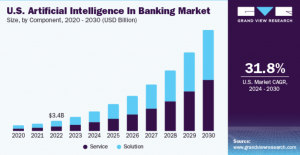

Artificial intelligence is changing how the world works, and finance is no exception. From how banks lend money to how they follow regulations; AI is becoming part of every step. Over the past few months, financial institutions have begun to invest in or acquire AI companies that help them move faster, operate more efficiently, and meet new compliance standards. These deals show how the financial world is not only adopting AI but also trying to control the risks that come with it.

AI-driven acquisitions

In October, the UK-based company CUBE, which builds software to help banks meet regulatory requirements, acquired Kodex AI, a startup in Germany that creates intelligent tools for compliance teams. Kodex uses what it calls “agentic AI,” meaning its systems act almost like coworkers, automatically reading new financial rules, summarizing them, and drafting reports. By adding Kodex to its platform, CUBE hopes to make compliance work quicker and more reliable for global institutions. Together they are developing what CUBE calls the first unified platform that connects compliance, risk management, and AI automation.

That same month, OpenAI purchased a smaller investment startup called Roi. Roi developed an app that used AI to give people personalized investing advice and track their portfolios. While Roi will shut down its original service, OpenAI is keeping the team and technology. This move shows that even major AI companies are looking to bring financial expertise in-house, as the line between technology and finance becomes less defined.

Another headline from October came from Revolut, one of Europe’s largest financial technology firms. Revolut acquired Swiftly, a Berlin-based startup that specializes in AI tools for travel booking and payments. Swiftly’s system allows users to plan trips, pay for them, and handle invoices through AI-driven conversations. Revolut’s goal is to make its app more personal and efficient for users. While not directly about compliance, the deal still shows how companies are working to use AI responsibly in areas that involve sensitive financial data.

How traditional finance is responding

The movement is not limited to startups. Major banks are also rethinking how they manage AI. UBS recently hired Daniele Magazzeni from JPMorgan to become its first Chief Artificial Intelligence Officer. His role will focus on making sure AI helps improve decision-making and client experience while staying within the boundaries of global regulations. This new position reflects how seriously banks now take AI governance and the need for transparency in the systems they use.

In early November, United Fintech, a London-based digital transformation group backed by large banks such as Citi and BNP Paribas, announced that it had acquired Trade Ledger, a company that designs AI-powered software for business lending. Trade Ledger’s tools allow banks to evaluate loans and analyze credit risk using real-time data rather than traditional manual reviews. The platform is already used by major institutions including Barclays and the Bank of Queensland. The acquisition was structured as an all-share deal, meaning that Trade Ledger’s founders became shareholders in United Fintech, a move that shows long-term trust in the partnership.

Christian Frahm, United Fintech’s CEO, said that Trade Ledger represents the next step in building a fully digital infrastructure for commercial banking. The goal is to help financial institutions automate their operations while keeping them secure and compliant in the new era of AI.

Why it matters

These recent deals reveal a major shift across finance. Banks and technology companies are not only adopting AI to make things faster but also using it to manage risk and meet new regulatory expectations. Instead of building these capabilities from scratch, they are buying or partnering with firms that already specialize in compliance technology. This approach saves time, builds credibility, and brings experienced AI teams inside the organization.

The result is a financial industry that is transforming from within. As regulators tighten rules around data privacy and algorithmic transparency, firms that can balance innovation with responsibility will have the upper hand. AI may still feel like a frontier, but the race to control it has already begun, and it is being led not just by tech giants but by the banks and institutions that keep the world’s money moving.

Contact Sara at kathursa@shu.edu