BlackRock’s Strategic Move into AI Infrastructure: What It Means for the Future

Kenneth Lionel

Staff Writer

BlackRock, alongside key partners including MGX and Global Infrastructure Partners (GIP), is making a landmark investment in AI infrastructure by acquiring Aligned Data Centers in a $40 billion transaction. This acquisition represents one of the largest-ever deals in digital infrastructure and signals a profound, long-term commitment to the real estate and energy systems underpinning artificial intelligence. With AI’s appetite for compute power surging, ownership of data centers—the physical backbone supporting AI models, supercomputers, and cloud platforms—is emerging as a critical strategic priority.

The GIP Acquisition and Capital Growth

This acquisition underscores BlackRock’s decisive pivot toward AI-related infrastructure. GIP currently manages approximately $170 billion in capital and aims to grow this to $210 billion by early 2026. Through partnerships with MGX—an AI-focused investment arm backed by Mubadala—and the AI Infrastructure Partnership (AIP), which includes Microsoft and NVIDIA, GIP is positioning itself as a dominant player in the global data infrastructure ecosystem. Acquiring Aligned, with its 50 data center campuses and 5 gigawatts of active and planned capacity across North and Latin America, accelerates the firm’s ability to capture AI infrastructure growth. This deal reflects an evolution beyond traditional asset management toward tangible, long-lived infrastructure assets central to digital industrial expansion.

Why Data Centers Are the New Gold Rush

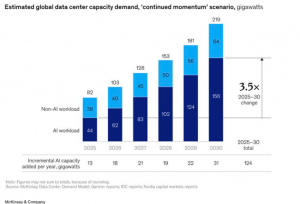

AI’s infrastructure requirements are growing at a staggering pace. Industry projections estimate that AI computing could eventually consume up to 6% of U.S. electricity by decade’s end, underscoring the scale of power and real estate needed. Hyperscalers and AI developers—from OpenAI and Anthropic to Amazon—are rapidly securing physical space and energy resources to fuel their compute-heavy workloads. Amazon’s recent supercomputer facility for Anthropic, built on newly acquired farmland in Indiana, highlights how AI infrastructure demand is reshaping real estate markets and energy grids across the U.S.

Tech Giants Fueling the Infrastructure Boom

The AI ecosystem is increasingly interconnected with semiconductor innovations. Intel, AMD, Broadcom, and NVIDIA supply the chips enabling AI workloads, while Qualcomm’s successful launch of AI-competitive chips has invigorated market excitement. Google’s strides in quantum computing and next-generation supercomputing processors further intensify the arms race for AI performance. As OpenAI approaches a $1 trillion valuation ahead of a potential IPO, the acceleration in AI technology and investment is indisputable.

The Broader Investment Implications

This transaction is not a chase after fleeting hype. Rather, it is a foundational investment in the infrastructure necessary for sustained AI growth. Estimates suggest over $70 billion in M&A activity occurred in AI and data infrastructure in 2025 alone, with numbers expected to double in 2026. The consolidation of large-scale data center assets signals recognition among institutional investors that AI represents a structural industrial transformation—not a bubble.

Global Ripple Effects

As U.S. investments in AI infrastructure deepen, geopolitical dynamics around semiconductor supply chains and infrastructure ownership come to the fore. Regions traditionally strong in chip manufacturing, such as China and Taiwan, may face heightened competitive pressures amid trade tensions. Notably, despite tariffs and disputes, semiconductor demand remains robust, exemplified by a recent surge in orders for Dutch semiconductor firms that defied expected slowdowns.

Looking Ahead: The Future of AI Infrastructure

The race to build AI capacity is reshaping capital markets, real estate, power systems, and technology supply chains. BlackRock’s and GIP’s leadership in this space positions them among the foremost influencers of this digital industrial age—an era where owning AI infrastructure assets could rival the strategic value of traditional energy resources. As major players like Blackstone and MGX increase their stakes, this investment surge represents the genesis of a multi-trillion-dollar restructuring of the global economy.

Conclusion

BlackRock’s backing of the Aligned Data Centers acquisition is more than an infrastructure transaction—it is a strategic declaration on the direction of capital and technology innovation. By securing essential data center real estate and energy assets, BlackRock and its partners are laying the groundwork for the next wave of technological and economic expansion. Far from speculative surges, these investments mark a durable transformation of global markets centered on AI and its physical infrastructure.

Contact Kenneth at kenneth.lionel@student.shu.edu