Spotify’s Recent Price Hike: What’s Different, Why It’s Significant, and What’s Next

Daniel Kassim

Staff Writer

The Price Increase

Spotify raised prices on multiple tiers of subscription, going after already shrinking users’ wallets in this current economy. Individual Premium plans rose from $10.99 to $11.99; Duo plans rose from $14.99 to $16.99, and Family plans rose from $16.99 to $19.99. Student prices remained at $5.99, which they were very considerate about. The company cited expansion in spending on audiobook listening, AI capabilities, and infrastructure development. Premium subscribers have 15 hours a month of audiobook listening time, more than 200,000 titles, and add-ons like DJ mode, which mixes music with commentary developed using AI. The price hikes became effective in the United States, United Kingdom, and other international markets starting September.

Industry Pressures and Platform Competition

The price hike mirrors all other streaming platforms as they fight to stay consistent with creators and content. Spotify’s 236 million Premium subscribers last quarter, in the meantime, decelerated growth from lockdown and distance-learning listening marathons. Music license fees went up as artists and labels negotiated more per-stream pay, margin-cutting on platforms. The firm made big podcasting buying wagers, picking up high-profile exclusive programs that own morning commutes and late-night homework sessions. Spotify’s most notable bet was signing Joe Rogan to an initial deal reportedly worth over $200 million in 2020, followed by a three-year, $60 million exclusive deal with Alex Cooper’s “Call Her Daddy” podcast in 2021, and acquiring entire podcast production studios including Gimlet, Anchor, Parcast, Megaphone, and Bill Simmons’ The Ringer. Music license fees went up as artists and labels negotiated more per-stream pay, cutting into platform margins. Apple Music bumped the price up to $10.99, YouTube Premium up to $13.99, and Amazon Music raised prices. With multiple subscriptions activated within a short time frame, the cost quickly adds up, with the cost of streaming totaling what would once have been spent on coffee breaks or weekend excursions. Spotify added group playlists, video podcasts, and more personalization with a view to charging higher monthly fees. The battle for original content has sites bidding against each other for top writers, with prices going up across the board. Roommates sharing an account now debate if premium features are worth everyone pitching in extra or downgrading to individual student plans.

Free Tier Experience Changes

Those on the free tier dodged the price increases but had their ad-supported experience altered in small, positive ways. Spotify experimented with new features for free accounts, offering temporary lyric access in certain areas and increasing podcast offerings. Ad frequency increased and became more clearly targeted to your listening patterns, inserted between songs based on what’s being streamed during late-nighters versus morning runs. Branded playlists found their way into discovery streams, mixing in brand tie-ins alongside legitimate music recommendations. Mobile listeners are restricted to shuffle-only, but laptop listeners receive on-demand listening while they study. Skip restrictions are maintained for ad-supported mobile accounts, capping quantities of songs skipped when a song murders the vibe. Video podcasts were made accessible to ad-supported listeners in test markets, dividing episodes with visual ads. The free version is acceptable for occasional listeners who don’t mind interruptions.

Emerging Markets: Spotify’s Growth Engine

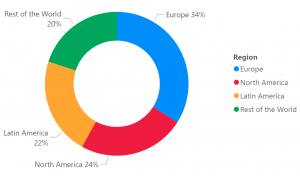

Spotify has become widespread in Brazil, with Brazilian artists earning over 1.6 billion Brazilian reals in royalties alone in 2024, a 31% increase from last year. This indicates that these emerging markets are not only adding subscriber base but constructing thriving music ecosystems. Spotify has emerged as the leader of paid streaming in India, accounting for 26% of paid streams, with premium subscriptions growing by 85% year over year during 2022. The company’s cost-localization strategy wins over these markets. Spotify has operations in 184 nations and is expanding rapidly in Africa and Southeast Asian markets. But achievement there requires varied approaches compared to in mature Western markets. India’s and Southeast Asia’s price-conscious customers desire cheaper subscription prices, so Spotify must enroll much higher numbers of them in order to match the revenue that is being realized in North America or Europe. Company executives view India as being on a similar growth path as Latin America, where paid user penetration has increased steadily over the years. These growth markets offer Spotify its strongest opportunity for growing its user base when subscriber growth in the United States and Western Europe slows down, but monetization per user will be reduced in the near term.

What’s Next for Spotify’s Future

The streaming landscape will likely see Spotify introduce a premium-plus level as budgets are cut and as subscribers review what they actually need. Analysts anticipate an even more premium edition with higher quality, lossless audio, unlimited audiobook listening, and early availability on new devices for subscribers willing to spend even more. Developing AI capabilities may include generating music or anticipating precisely what to play at different times of the day. Expensive budgets cause subscription hopping to become even more common, keeping Spotify for busy semesters but canceling it for summer sessions when usage is more casual. Family plan subscribers will consider whether or not higher prices are worth it in keeping everyone on the same plan or everyone else switching to more affordable student plans. Expansion in Brazil, India, and Southeast Asia can offset slowing growth in markets where most of the subscribers already reside. Spotify’s audiobook initiative turns the service into something different from background music for college kids, potentially adding study material to contend with other study resources. Bundling with phone operators or other services can be areas for platforms to tie subscribers down. Payout wars between creators will still be raging as creators fight for more per-stream payouts, even dictating the way platforms pay for content and what it does towards future price increases.

Contact Daniel at daniel.kassim@student.shu.edu