Fed’s Outlook on Rates, Markets, and Economic Growth

Ethan Digiacomo

Staff Writer

Fed’s Outlook on Rates, Markets, and Economic Growth

On March 19th, the Federal Open Market Committee (FOMC) had its second annual meeting. The chairman of the Federal Reserve, Jerome Powell, said that he expects no progress made to lower inflation during the year. Powell blames the lack of progression on the new tariffs imposed by President Trump. Despite this prediction, the Fed is still planning to maintain its 2024 projections and expects to make two interest rate cuts in 2025. Unlike 2024, when the Fed prioritized a soft landing by easing policy to support economic growth and accommodate inflation trends, the 2025 outlook is more cautious. Policymakers are now divided into two camps: one emphasizing downside economic risks and another focusing on upside inflation risks. The majority of policymakers agree with this, as eight out of the ten forecasted one or no cuts this year, while only two thought the Fed would lower rates by 75 basis points this year. However, Powell projects that the economy will become weaker and the unemployment rate will get higher, which are the reasons to cut rates. Despite these seemingly contradicting views, Powell hopes they will offset each other and is sticking with the planned two interest rate cuts. Powell justified the unchanged rate cut projections by citing weaker growth expectations and heightened economic uncertainty. He acknowledged that soft data signals growing concerns among private sector participants, but hard data still indicates a resilient economy. Powell also stated that while recession risks had increased, they were not yet considered high. However, there is a concern that the Fed’s reactive stance could leave it behind the curve, as deteriorating soft data often translates into weaker hard data with a lag of three to six months. Additionally, the FOMC announced that it will slow the pace of its balance sheet reduction starting in April. The monthly redemption cap on Treasury securities will be reduced from $25 billion to $5 billion, while the cap on agency debt and mortgage-backed securities will remain at $35 billion.

What did the Fed do to Interest Rates?

The other notable point made at the meeting is that the federal funds rate is being held steady at 4.25-4.5%; this follows a pause from January and three previous cuts in 2024, lowering the rate from 5.5% to 4.5%. There is yet another pause because Powell believes that the economy is progressing steadily and “does not need to be in a hurry to adjust policy and is well positioned to wait for greater clarity.” This reflects the Fed’s opinion that by the end of the year, inflation will remain somewhat high, the unemployment rate will remain stabilized at a low level, and labor markets will continue to be stable. The markets reacted positively to this decision. The move wasn’t as hawkish as many investors feared, with the S&P 500 closing up about 1.1% higher

The Summary of Economic Projections (SEP)

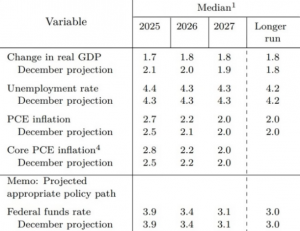

Since the December projections three months ago, the Fed has lowered its GDP growth rate for this year from 2.1% to 1.7%. Currently, the unemployment rate is at 4.2%, higher than current expectations of 4.1%, and it is projected to end this year at 4.4%. Personal Consumption Expenditures (PCE inflation) measures the changes in prices of goods and services that people in the U.S. buy. In December, Core PCE inflation was expected to be at 2.5% by the end of 2025 and has increased to 2.8%. This is worrying the investors, as the Fed expects lower GDP growth and higher inflation and unemployment, yet Powell does not expect to cut interest rates more than in December. However, Powell expects interest rates to fall closer to 2% by 2026, and inflation is only rising because of tariffs and the new policies enacted by President Trump, specifically with immigration, trade, regulations, and fiscal policy.

Effect of Tariffs on the Fed’s Predictions

Goldman Sachs recently changed their estimates on the probability of a recession occurring in the next 12 months from 20% to 35%. One reason for the exaggerated increase is due to Trump’s tariffs. On April 2nd, Donald Trump announced a new tariff plan that includes a 60% tariff on all Chinese imports and a 10% universal baseline tariff on all foreign goods, except for Canada and Mexico, to protect U.S. industries and reduce the trade deficit. Similar to Goldman Sachs, Powell believes that due to the tariffs, “further progress may be delayed” on getting inflation back to the central bank’s 2 percent target. That recognition materialized in the higher inflation forecasts in the FOMC’s economic projections. However, Powell also said that the future “remains uncertain,” but he is confident the Fed can respond to sharp shifts in the trajectory for the economy and could afford to be patient about making rate decisions given the conditions of the labor market. He reiterated that point, pushing back on the negative view of consumer expectations on inflation and the economy that has shown up in recent survey data.

What’s Next?

Although this meeting felt like it was pushing the problem down the road until the Fed’s May meeting, it left the rates market in a favorable position. By maintaining the current number of rate cuts while also acknowledging the temporary impact of tariffs on inflation, the Fed provides a credible path to reducing the federal funds rate. Looking ahead, the Fed is expected to implement two 25 bps rate cuts in 2025, likely in June and December. However, investors should remain vigilant, as the Fed’s reactionary stance means that policy could shift quickly in response to economic and labor market data. If economic conditions weaken significantly, the Fed may pivot toward a more calm approach, while a persistent rise in inflation expectations could prompt a more hawkish stance.

Contact Ethan at Ethan.Digiacomo@student.shu.edu