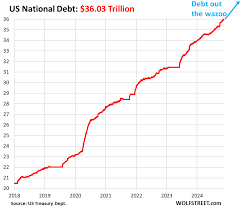

U.S. National Debt Reaches $36 Trillion: A Growing Concern

Aaron Stanway

US/Int News Editor

The U.S. national debt has surged to an alarming $36 trillion, sparking fresh concerns about the country’s economic future. While consumer debt—comprising mortgages, student loans, and credit card balances—has exceeded $18 trillion, economists argue that the mounting federal debt poses an even greater long-term risk. With interest payments now making up a significant share of government spending, fears of inflation, rising interest rates, and potential economic instability have intensified.

Rising Interest Payments and Inflation Risks

As the national debt grows, so does the cost of servicing it. Interest payments on the debt are projected to exceed $1 trillion annually, diverting funds that could otherwise be spent on critical infrastructure, education, and social programs. With the Federal Reserve maintaining higher interest rates to combat inflation, borrowing costs for the government continue to rise.

Many analysts warn that unchecked debt accumulation could trigger economic instability. If investors begin to doubt the U.S. government’s ability to manage its fiscal policies effectively, borrowing costs could spike further, leading to even higher interest rates and potential devaluation of the dollar.

Government Spending and Revenue Challenges

The widening gap between government spending and revenue collection remains a core issue. Entitlement programs like Social Security, Medicare, and Medicaid account for a large portion of federal expenditures, and efforts to reform these systems are often met with political resistance. Meanwhile, tax revenues—though substantial—are often outpaced by spending, exacerbating the deficit problem.

DOGE’s Role in Reducing Fraud and Waste

One potential strategy to curb unnecessary spending and reduce the deficit involves eliminating fraud, waste, and abuse within government programs. The Department of Government Oversight and Efficiency (DOGE) has reportedly identified billions of dollars in fraudulent transactions, misallocated funds, and inefficiencies across multiple federal agencies.

Through advanced AI-driven fraud detection systems, DOGE has been able to track and flag suspicious financial activities, leading to the recovery of misused funds. In recent years, government watchdogs have found fraudulent claims in Medicare, welfare programs, and defense contracts, costing taxpayers billions. By tightening oversight and implementing stricter financial controls, experts believe the government could significantly reduce unnecessary expenditures. The long term effectiveness of DOGE still remains to be seen.

The Path Forward

While the national debt crisis remains a pressing issue, solutions exist. Fiscal responsibility through spending cuts, better oversight, and revenue adjustments could help slow the debt’s growth. If departments like DOGE continue their efforts to eliminate fraud, the U.S. may find innovative ways to balance its budget without sacrificing essential public services.

Contact Aaron Stanway Aaron.stanway@student.shu.edu