M&A and IPOs are Driving Market Growth in India

Thaddius Gamueda

Staff Writer

Over the past month, many investors have begun to look at international markets to seek alternative returns for their portfolios. Some investors sought out the Chinese stock market surge and have been seeing high growth in the Chinese market. Because of the attractiveness of emerging foreign markets this year, India has been a prime investment target. The Indian market has seen drastic growth in Mergers and Acquisitions (M&A) and Initial Public Offerings (IPOs). But what sectors should new investors begin to look at, and what are the risks in investing in the evolving Indian market?

What are M&A and IPOs?

First, we need to understand what M&A and IPOs are. M&As refer to the combination of assets between two or more businesses. Mergers happen when two or more companies decide to combine their assets and become a single firm. Acquisitions are different because one larger firm acquires all parts of another firm. Essentially, one firm absorbs all parts of another. IPOs allow private companies to raise equity from public investors. These offerings are put into the primary market so that new investors can begin to invest. India’s economy has seen drastic growth this year in both M&A and IPOs.

What Sectors are Leading in M&As and Creating Growth?

In the past three quarters, the global M&A market has begun a recovery after high inflation rates and increased borrowing rates that started in mid-2022. According to PicthBook, the global trends show the M&A market having accelerated growth with a 13.3% growth in deal count compared to last year. These are great numbers, but compared to India, there has been a 66% surge in the number of M&A deals in the past nine months of 2024 compared to the same period from 2023 according to Boston Consulting Group. The main sectors that have contributed to this unbelievable growth include media, technology, healthcare, and industrials. Looking forward, many of these industries have healthy companies with strong balance sheets that are looking for as many growth opportunities as possible.

Which New Companies’ IPOs are Intriguing Investors?

In the first eight months of 2024, IPOs raised a total of $12.2 billion, and a total of 227 IPOs were rolled out. Some recent IPOs that interested the investors, in particular, are Hyundai India, Swiggy, NSE WAAREE Energies, NTPC Green Energy, and MobikWik. Hyundai India is a leading car company that launched a record-breaking $3.3 billion dollar IPO on October 22nd, the largest IPO in India to date. Swiggy is a food delivery company similar to companies like DoorDash or Uber Eats. Swiggy has filed for a $1.25 billion IPO that is set to launch in the coming months. MobikWik is an Indian payment company that allows its users to have a digital wallet when they shop. At the beginning of the year, MobikWik sought out a $84 million IPO deal and was one of the first companies to start the trend. WAAREE and NTPC have received requests to become public companies and are in the process of creating their own IPOs that are coming out soon.

Should You Begin Investing in the Indian Market?

Besides Boston Consulting Group, other big-name companies have begun to see India as a top market to harness. J.P Morgan’s top brass believes India is a hotspot as Bloomberg has reported that nearly $9 billion has been raised through IPOs this year. Deloitte has reported that global manufacturing companies have begun to investigate M&A with Indian manufacturing companies that will drive growth in India’s market. Deloitte has also reported that they believe the FinTech sector is expected to reach $150 billion in 2025, and it will continue to

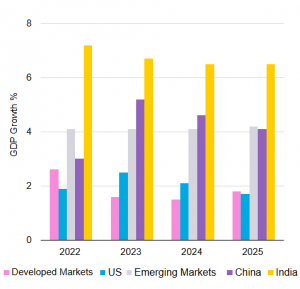

bring in fresh investments to the sector. Citibank’s Arvind Vashistha is endorsing the Hyundai India stock and is confident that it will perform up to investor’s expectations. Although there is a positive outlook in the long run for the new IPOs, the Hyundai India stock dropped 7% on its trading debut shaking its investors. Although this is the case, India’s long-term outlook is very promising. They are the fourth largest economy in the world, and they are growing at a similar rate to China from 2007-2012 according to Morgan Stanley analysts. Investors should understand the amount of risk they can take on and what timeframe they want for their portfolio before truly deciding if investing in the Indian market is the right choice for them.

Contact Thaddius at Thaddius.Gamueda@student.shu.edu