Business Borrowing Booms: Why Corporates Are Betting Big in 2026

Sara Kathuria

Staff Writer

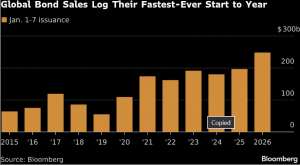

Corporate borrowing is off to a fast start in 2026, with companies issuing record amounts of debt and banks reporting stronger demand for business loans. Even with interest rates still higher than a few years ago, firms are choosing to borrow more, not less. So, why are companies taking on more debt right now?

Replacing old debt

A major reason companies are borrowing more this year comes down to timing. During the pandemic-era in 2020 and 2021, interest rates were extremely low, so many corporations took on debt because it was inexpensive to do so. Now, a large portion of that borrowing is reaching its maturity in 2026.

When those loans and bonds come due, companies usually don’t pay them off in full. Instead, they take out new debt to replace the old debt. It’s essentially rolling over what they already borrowed, just under today’s market conditions.

M&A deals driving new borrowing

Another reason companies are borrowing more is the expected rise in mergers and acquisitions this year. When a company wants to buy another firm or merge with a competitor, it often uses debt to help fund the deal rather than paying entirely in cash.

For example, Netflix is set to acquire the television studio operations of Warner Bros. Discovery, including HBO and Max, in a deal valued at about $82.7 billion.

The same pattern can be seen in the luxury space. Prada’s move to acquire Versace is a clear example of how major brands are using acquisitions to grow their global presence and attract new customers.

AI and infrastructure spending surge

Running AI systems requires enormous investment in data centers, chips, and cloud networks. These projects cost billions of dollars upfront, so many firms turn to debt to help cover the cost while they scale up their technology.

These include companies like Microsoft and Amazon that are expanding data centers across the United States to support the rapid growth in cloud computing and AI services.

The impact spreads beyond the tech giants themselves. Data center operators such as Equinix and Digital Realty are also raising debt to construct new sites and upgrade existing ones.

This wave of investment creates a ripple effect across industries. As the largest tech companies spend heavily on AI infrastructure, the companies that supply them with buildings, equipment, and materials also increase their own borrowing to keep pace with the growing demand.

Banks grow more willing to lend

On the other side of this trend, banks themselves are becoming more open to giving out loans. A recent Federal Reserve Senior Loan Officer survey found that demand for business loans from large and mid-sized companies increased in late 2025, and banks expect that demand to keep rising throughout 2026.

The survey also showed that banks are no longer planning to tighten their lending standards the way they did last year. When credit is easier to access, firms are more likely to borrow to fund new projects, hiring, or expansion.

There was also a noticeable shift tied to artificial intelligence. Banks reported being more willing to lend to companies that have strong exposure to AI, since many lenders see those firms as having higher growth potential.

Broader implications

Rising corporate borrowing shows how companies are viewing the economy in 2026. Many firms are still taking on debt to fund acquisitions, AI projects, and long-term expansion, even with interest rates higher than they were a few years ago. That signals businesses expect future growth to justify the added borrowing.

Much of this outlook depends on the Federal Reserve. The Fed has kept its benchmark rate around the 3.50% to 3.75% range and may delay rate cuts if inflation remains elevated, which would keep borrowing costs high for companies issuing new debt.

If rates stay high or growth slows, borrowing could ease later in the year. For now, though, the strong pace of debt issuance shows companies are still moving ahead with major investments, betting that future growth will outweigh today’s higher borrowing costs.

Contact Sara at kathursa@shu.edu