QT is Dead, The Next Wave of the Fed’s Quantitative Easing

Daniel Kassim

Finance Writer

The Federal Reserve just hit pause on shrinking its balance sheet. After years of Quantitative Tightening, the Fed now signals a return to Quantitative Easing. Here’s what that means for your wallet, your student loans, and the economy you’ll graduate into.

What Actually Happened

The Fed spent 2022 and 2023 pulling money out of the financial system. They are referred to as Quantitative Tightening, or QT for short. The goal is pretty simple to cut down the huge amount of cash they pumped into the markets during COVID, slowing inflation down, and getting things back to normal.

Now they are done; QT is dead.

Fed Chair Jerome Powell announced the move late in 2024; now, the central bank will resume buying bonds and pump money into the economy once again. It is a faster turnaround than many economists had anticipated.

Fed Chairman Jerome Powell Addressing the Media (Courtesy of the Wall Street Journal)

Why the Fed Changed Course

You got to understand what forced this decision: the banking system was showing its cracks. Regional banks were struggling with liquidity. Overnight lending markets, a mess-even Treasury market, where the government borrows money, started acting weird.

The Fed saw warning signals everywhere. Instead of continuing with QT, they opted for stability. Banks need reserves to operate; when those reserves start getting too low, the whole system wobbles. The Fed decided the risk was too high.

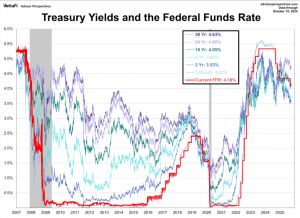

Inflation fell enough to justify the shift. Having peaked above 9% in summer 2022, it had fallen to around 3% by late 2024. Not perfect, but manageable. This gave Powell room to pivot.

What Quantitative Easing Actually Does

QE does sound complicated, but the mechanics are relatively simple.

The Fed digitally creates money. They, in turn, use this new money to buy Treasury bonds and mortgage-backed securities from the banks. Now, the banks have more cash sitting in their reserves. They can then lend this money to businesses and consumers. More lending equates to more spending. More spending increases the economy.

This floods the financial system with liquidity. With more money chasing the same quantity of loans, interest rates fall. The cheaper borrowing costs spur businesses to expand and hire, and homebuyers can afford mortgages. The stock market typically rallies as investors seek better returns than bonds offer.

But there’s a catch: print too much money, and inflation comes roaring back. The tightrope that the Fed walks is growth versus price stability.

The New Round Looks Different

This is not 2008 or 2020. The Fed learned from those episodes.

They’re moving more slowly this time. The purchases will be measured and deliberate. Powell made clear that they won’t repeat the fire hose approach from the pandemic. Expect a steady drip, not a flood.

The focus also shifts: the Fed wants to support market functioning more than boost economic growth. They are going to be focusing on keeping Treasury markets liquid. They’ll also make sure the banks have adequate reserves. Think of plumbing repair, not economic stimulus.

You’ll also see better communication: The Fed got criticized before for surprising the markets. This time, they’re telegraphing every movie. When you’re creating trillions of dollars, transparency really matters.

Winners and Losers

With QE, some groups benefit directly, while others get squeezed.

Investors in stocks benefit because more money in the system drives the prices of assets up, companies with high levels of debt also benefit as borrowing becomes cheaper for them, and real estate bounces back because mortgage rates decline, which increases the demand for housing.

Savers lose: Your savings account already pays almost nothing. QE makes it worse. The interest you earn will lag inflation. Older Americans on fixed incomes struggle when safe investments like CDs and Treasury bonds pay peanuts.

For younger people, it is a mixed bag: to be sure, lower rates are helpful if you’re buying a house or starting a business, but it means asset prices climb faster than wages. The things you want to buy get more expensive, and you are competing against investors with cheap access to capital.

What It Means for You Right Now

Just when you thought your student loans couldn’t get any more interesting, they did. That’s because federal student loan rates are pegged to Treasury yields. When the Fed buys bonds and pushes yields, future borrowers will pay less. Current borrowers who have variable rates may catch a break. Those with fixed rates, however, are stuck with what they have.

It is easier to find employment. QE boosts economic growth. When borrowing is cheap and sales are high, firms hire. The labor market has remained tight. You may have more negotiating power for your salary and benefits.

But the rent keeps going up. Cheap money is great for landlords and real estate investors, who bid up property prices. Those higher costs get passed along to renters, so your monthly housing bill probably goes up.

Credit cards get tricky. Even though the Fed funds rate may stabilize or fall, credit card companies do not always pass savings to customers. Your APR stays high while other rates are falling.

The Inflation Question on Everyone’s Mind

Does that restart inflation? Maybe.

The Fed says it can control it this time. They have improved tools to control inflation. They are able to pay interest on bank reserves, which prevents excess lending. They can adjust the pace of purchases. They promise to react quickly if prices spike again.

Markets are not entirely convinced. Bond traders already price higher inflation down the road. They remember what happened last time the Fed said that inflation was “transitory.” Trust takes time to rebuild.

The difference, for now, is starting conditions. The economy isn’t shut down like it was in 2020, supply chains work again, and the labor market has cooled from its post-pandemic frenzy. Those should all be factors limiting inflation pressure.

But risks remain. Government spending is still high; geopolitical tensions push energy costs upward; and food supplies are affected by climate-related disasters. Any of those, in concert with QE, could revive inflation.

Looking Ahead

The Fed is going to be committed to this path for at least the next year by buying bonds every month, seeing how markets respond. It speeds up when the economy sags and slows down when inflation heats up.

Meanwhile, the political pressure continues to ratchet up as fresh voices come into Washington in the wake of the 2024 election, politicians split between a desire for more aggressive easing to drive growth and clamoring for restraint to protect the value of the U.S. dollar. Powell must find a balance between crosscurrents while ensuring that the Fed keeps its independence.

International spillovers are not trivial: when the Fed eases, the dollar tends to weaken. That is good for American exporters but enrages trading partners. Other central banks may retaliate in a currency war by easing themselves.

You should be watching what the Fed is watching: monthly jobs reports that indicate the strength of the labor market; CPI releases reflecting inflation trends, and Fed meeting minutes showing their thinking. These all help you make more informed financial decisions.

The Bottom Line

QT is over; the Fed returns to creating money and buying bonds. That shall form the kind of economy which you will build your career in.

Be ready for lower interest rates and higher asset prices, easier access to jobs but tougher access to home ownership and keep an eye on inflation since it is the determinant of your real purchasing power.

From your paycheck to the rent you pay to your retirement account, everything is connected by what comes next. You may not be in charge of monetary policy, but you can understand it. And by doing so, it will give you an edge in planning your financial future.

Stay informed. It all gets published online by the Fed. Read the statements. Watch Powell’s press conferences. Your best defense against whatever’s to come next is knowledge.

Contact Daniel at daniel.kassim@student.shu.edu