Brookfield Asset Management to Acquire Remaining Stake in Oaktree Capital Management (~3 bn) to Boost its Credit Business

Sara Kathuria

Staff Writer

Brookfield Asset Management is taking full ownership of Oaktree Capital Management, acquiring the remaining 26 percent stake for about $3 billion. The deal, expected to close in early 2026, will give Brookfield complete control of one of the world’s most respected credit investors and further solidify its position among top global alternative asset managers.

Strengthening a core business

Brookfield, headquartered in Toronto, first purchased a majority stake in Oaktree in 2019 for $4.7 billion. That initial investment gave Brookfield a critical foothold in private credit and distressed debt markets—segments that have become increasingly central to institutional investors seeking steady returns outside traditional lending.

Since joining forces, Oaktree’s assets under management have grown roughly 75%, a reflection of the firm’s strong performance and the rising demand for credit-focused funds. By moving from partial to full ownership, Brookfield aims to integrate Oaktree’s capabilities across its broader investment platform, which already spans infrastructure, real estate, renewables, and private equity.

Why the deal matters

This acquisition comes at a time when private credit is reshaping global finance. With banks lending less amid tighter regulations and higher interest rates, firms like Brookfield and Oaktree are stepping in to fill the gap, offering flexible financing to corporations and investors. Gaining full control of Oaktree gives Brookfield greater influence in this space, positioning it to compete directly with industry giants such as Blackstone and Apollo.

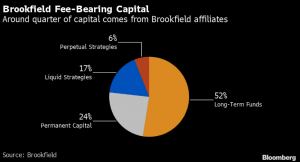

The deal also reflects a strategic shift for Brookfield. Known historically for its real asset investments, the company has been steadily diversifying into credit, viewing it as a stable, recurring source of revenue. By unifying operations with Oaktree, Brookfield strengthens its ability to manage risk across economic cycles while expanding its range of products for global clients.

Leadership and integration

Leadership continuity will play a central role in guiding this transition. Howard Marks and Bruce Karsh, Oaktree’s co-founders, will remain deeply involved as senior advisors, preserving the firm’s investment philosophy and client relationships under Brookfield’s ownership. Their continued presence reinforces the credibility and stability behind the combined platform.

Robert O’Leary and Armen Panossian, Oaktree’s co-CEOs, will assume expanded roles as heads of Brookfield’s global credit business, integrating Oaktree’s expertise with Brookfield’s global reach. Together, they will oversee one of the largest credit operations in the world.

Brookfield CEO Bruce Flatt described the acquisition as “a natural next step” that brings the best of both firms under one framework. He emphasized that the combination will enhance collaboration, accelerate growth in private credit, and strengthen Brookfield’s long-term ability to deliver consistent results for investors.

Broader implications

The transaction also reinforces Brookfield’s growing presence in the United States, where more than half of its employees are based and a large portion of its revenue is generated. Including Oaktree, Brookfield now manages over $1 trillion in assets, with credit becoming one of its fastest-growing divisions.

Ultimately, Brookfield’s full acquisition of Oaktree strengthens its foothold in credit investing and highlights how the firm continues to adapt to a changing global market.

Contact Sara at sara.kathuria@student.shu.edu