Sell-Off of the U.S. Treasuries

Mihran Maldjian

Staff Writer

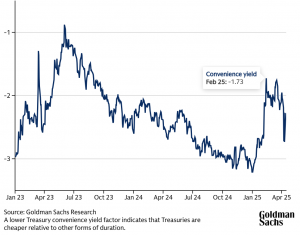

While the stock market is experiencing turbulence due to America’s new tariff policies, investors are taking a step back due to uncertainty. In unusual circumstances like this, investors target U.S. Treasury bonds, a safer investment backed by the full faith and credit of the U.S. government. The shift of focus from the stock market to treasuries would usually raise treasury prices due to more capital being poured into treasuries; however, this time, treasuries unexpectedly lowered in price. In fact, it lowered tremendously, with the treasury yields spiking sharply, the biggest one-week spike since 2021. While this may be confusing, there are reasons for this surprising outcome which are very nuanced and concerning.

The most probable reason is the way hedge funds manage their bonds. In the treasury bond market, there are two common trading strategies: basis trades and swap spread trades. Both involve going long treasuries while shortening related assets against it. For basis trade, treasury futures would be shortened against it, and for swap spread trade, they would use interest rate swaps. These trading strategies do not make a lot of money on their own because they end up with only small price differences resulting in miniscule profits when sold, but hedge funds manage to find a way to make them heavily profitable through the repo market. The repo market is where instead of a hedge fund investing in bonds with only their own money, they manage an agreement with a bank for short term loans to buy bonds in larger volume and in return use the bonds as collateral for the loans. This way, despite the profit percentage return remaining small, it is amplified into larger dollar amounts because it is applied to a much bigger base investment.

This seems like a fool-proof plan to get very rich very fast, but unfortunately, it has an extremely bad downside. If the treasuries drop down even in the smallest amount, it hits hedge funds with a devastating loss. Hedge funds will still need to sell their bonds to pay back the loans, but if the bond price is lowered, that means each individual bond price has lowered. Because these hedge funds buy enormous volumes of bonds, the smallest change in the price of the bond has a huge impact. That is exactly what happened, as treasury bonds unexpectedly lowered along with the stock market.

The banks were aware of the decreased value of the bonds currently being used as collateral, and as the value of bonds drops, they become not enough to be held as collateral for the loans. This results in hedge funds receiving what is known as margin calls, where the banks who lent money to hedge funds demand more collateral to be held for the loans. To meet these calls, the hedge funds sold all their treasuries to get quick cash to satisfy the bank lenders, and almost all the money is given back to the lender, leaving the hedge funds in trouble. The main concern though for the bond market was all these hedge funds selling off their massive volume of treasuries around the same time. This caused the treasury bond price to plummet further and quicker, making a constant spiral downwards as more margin calls were sent to other hedge funds causing more selling and more price falling. This disastrous event is commonly known as the Value-at-Risk shock.

There is speculation that foreign countries invested in treasuries also had an impact in this crash. Countries buy US treasuries for a number of reasons such as secure investment, currency stabilization, easy profit, maintaining economic relations, and more. It is reasonable to assume that countries invested in treasuries may have sold their bonds in result of the steep decline in price due to their concerns about pressures on stabilizing their currency or concerns of a loss, and because countries typically have a lot of money to use, they would contain a large volume of bonds, which when sold, would have a big impact on the bond market.

This turn of events for the bond market was certainly a surprise to everyone, as now that the stock market has become volatile, it is safe to assume many people would turn to treasuries, resulting in higher prices due to higher demand. Unfortunately, that is not what occurred in this instance, and many are left wondering how treasuries dropped in the first place before all the marginal calls and massive sell-offs from hedge funds and countries. The simple answer is the same one for why the stock market has been turbulent: tariffs. The large-scale placement of tariffs have set an expectation of rising inflation, which has people demanding discounted prices for bonds with the same fixed interest rate to outcompete inflation. This little tip over of lowered treasuries caused the chain reaction of marginal calls which collapsed the price of treasuries along with the stock market. These sequences of events have revealed the weaknesses in the bond market, and it is now dawning on Americans how the unshakeable secure bond market may not be the same safe market as they thought.

Contact Mihran at Mihran.Maldjian@student.shu.edu