Investing amid the U.S. uncertainties

Thaddius Gamueda

Staff Writer

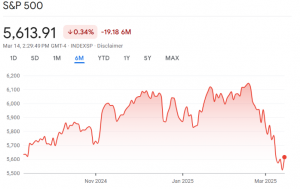

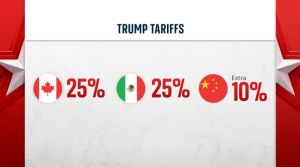

U.S. stocks have lost their gains since Donald Trump’s election at the end of 2024. The total amount has risen to over $5 trillion dollars lost over the past few weeks from the U.S. stock market according to CNBC. Donald Trump’s trade war with the world has caused uproar in the U.S. with investors and consumers alike. With new retaliation tariffs being added by Europe, China, Mexico, and Canada, fears of inflation and new taxes run amuck. As investors are panic selling, what sectors and countries have thrived off this brutal trade war?

Gold is Experiencing Growth

As the 25% tariffs on steel and aluminum imports went into effect on March 12th, gold prices went up. Gold has hit a record of $3,043/ounce amid the trade war tensions. Because many investors are pushing to hide from inflation, commodity trading has seen a rise after the steep drops in the stock market. Gold has always been seen as a constant in our world, and that is why many investors have shifted their funds to it. Although commodity trading seems to be a great place to store investor’s resources, commodity trading is volatile and much riskier than investing in the stock market because of the effects by geological and political events. Nevertheless, gold again proves to be the store of value for investors in uncertain times.

U.S. TIPS and Treasuries See Higher Trading

Due to the current fears of inflation from the tariffs, U.S. Treasury securities and Treasury Inflation-Protected Securities (TIPS) have captured increased investor attention. TIPS have gained traction as they provide a hedge against rising inflation ensuring that returns keep pace with the cost of living. Treasuries, known for their low risk and steady yield, have become another attractive option in an otherwise unpredictable market. This surge in trading activity underscores a broader shift toward defensive investment strategies. For risk-averse investors, incorporating these fixed-income securities into a diversified portfolio can help mitigate overall exposure to market swings and geopolitical uncertainties. As global economic conditions continue to evolve, U.S. TIPS and Treasuries stand out as reliable anchors in a portfolio seeking both preservation of capital and modest growth. Although these fixed income investments create steady growth with fixed payments, it limits the growth investors can see.

U.S. Infrastructure and Manufacturing

Amid the ongoing trade war, U.S. infrastructure and manufacturing sectors have demonstrated notable resilience and potential for growth. The 25% tariffs on steel and aluminum are the first of what seem to be many to come. These tariffs are disrupting traditional global supply chains, but there is a renewed emphasis on domestic production and the reshoring of manufacturing operations. This shift is bolstered by government initiatives aimed at modernizing infrastructure and stimulating local economies. As companies pivot to reduce dependence on volatile international markets, domestic manufacturing stands to benefit from increased investment and supportive policy measures. Investors are beginning to recognize that these sectors offer a promising blend of stability and opportunity for growth, particularly in a climate marked by uncertainty in global trade. The drive toward self-reliance in production and infrastructure development may provide a cushion against the adverse impacts of international disputes, offering a steady avenue for long-term gains.

What Should Investors do?

This time is confusing for many investors. Markets are down and it seems like a recession is on the horizon. There are two options – one, investors are encouraged to adopt a diversified strategy that balances defensive assets with opportunities for growth. A prudent approach involves allocating funds across various sectors like gold and U.S. government securities, as well as domestic industries such as infrastructure and manufacturing that stand to benefit from reshoring trends and government stimulus. This diversification helps mitigate risks by offsetting the volatility in commodity and international markets with the stability offered by fixed-income investments and growth potential in domestic sectors. Investors should remain vigilant, monitoring economic indicators and policy shifts, while also seeking professional advice to tailor their portfolios to the evolving landscape. By combining exposure to traditional safe havens with investments in sectors poised for long-term expansion, investors can better navigate the complexities of the current trade environment and position themselves for steady growth over time. This strategy could be great for older investors who are looking to ensure their wealth is safe during this volatile time.

The other option is to hold current stock investments and continue buying on the dip. Although this approach may incur short-term losses due to tariff-induced panic, it capitalizes on lower entry points and the market’s historical tendency to rebound. Investors using this strategy employ dollar-cost averaging, which helps smooth out purchase prices amid volatility. The U.S. stock market is at the same point before the elections. The past 2-3 months have seen amazing growth before the tariffs and could be a sign of a Trump economy in the long run. Ultimately, the decision depends on individual risk tolerance and long-term financial goals of each investor. Staying informed and consulting financial professionals remains crucial as market conditions evolve every day.

Contact Thaddius at Thaddius.Gamueda@shu.edu