Commodities Markets Experiencing Significant Volatility

Jeffrey Grynaviski

Staff Writer

Commodities Markets Experiencing Significant Volatility

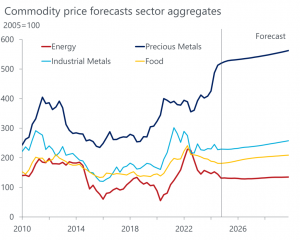

Prices of key resources in world markets have rocketed to all-time highs in 2024; the value of gold increased by 27% YoY breaking the $2600 per ounce mark at the end of 2024; similarly, cocoa surged 150% YoY, more than doubling in its value. For investors and especially businesses that depend on commodities, these jumps show a potentially volatile commodity market heading into 2025 that market participants must be prepared for.

The commodities market is the market where raw materials are sold. Commodities are raw materials used in the production of most goods. Unlike stocks and bonds which are based on the values or needs of a business for funds, commodities are determined by the supply and demand of the respective resources, and they are measured by the cost per unit of resources at a given time. Commodities include energy sources such as crude oil and natural gas, precious metals like gold and silver, as well as agricultural products like corn, wheat, sugar, coffee, cocoa, and cotton.

Agricultural Commodities

In the past year, several key commodities have changed drastically in prices. As a result of hazardous weather, the supply of cocoa dropped in 2024 leading to a historical spike in the price of cocoa, with the FED reporting a jump from around $4 per kilogram at the start of 2024, to surpassing $10 per kilogram by December. With over half of the global supply of cocoa produced in Côte d’Ivoire and Ghana (Africa), weather conditions and climate change are incredibly significant factors for the price of this commodity. According to the World Bank’s 2025 projection, more ideal conditions should allow for the cocoa market to cool and prices to slowly fall back down. While coffee prices did not have quite the same jump that cocoa did, prices still increased by a massive margin of 60% for arabica coffee and over 100% for robusta coffee. Both of these agricultural products are projected to decrease in 2025 because Brazil will have a milder year than in 2024. While the prices of cocoa and coffee shot up in 2024, wheat, another agricultural commodity, fell by over 20% in 2024. This trend is expected to continue in 2025 due to a growing supply of wheat. Overall, it should be expected that an anticipated calmer year of weather will lead to a decline in prices across most agricultural commodities as supply rebounds.

Precious Metals

In 2024, precious metals were some of the best performing commodities – both gold and silver grew by over 20%. In a new United States economy under President Trump, tariffs are far more likely to be used as a form of policy with foreign nations. With tariffs comes economic uncertainty, and during uncertain times investors have traditionally flocked to precious metals such as gold and silver as havens from inflation. CitiBank has already projected that gold could increase another 15% and break the $3000 per ounce barrier for the first time ever.

Silver demand is also expected to continue growing in 2025; however, silver mining is expected to grow at a similar rate which will likely offset some of the gains in higher demand. Most analysts are projecting silver to become worth over $40 per ounce, which is a near 25% increase in value.

Overall, 2025 could become a very lucrative year for investors and futures traders of precious metal commodities in 2025.

Industrial Materials

One commodity where the economic for 2025 looks rather bleak are the industrial metals. After a strong start in 2024, the price of copper has fallen back down to a net increase of over 7% on the year. The reason for copper’s current struggle in the markets is China, on of the largest manufacturers in the world. In the later half on 2024, China’s economy has slowed down, decreasing industrial production, and thus dropping its demand for industrial materials such as copper. In November, the Chinese government issued a $1.36 trillion dollar debt package attempting to stimulate activity. If this works, it will likely reinvigorate the currently declining market for copper. The combination of a questionable China and looming tariffs lead to an incredibly volatile market for copper in 2025 with some projections having the resource decline, and others predicting large growth, with the most common assumption being around 14%.

Last year presented significant upside opportunities for investors in commodities markets, as increased volatility created ideal conditions for traders to capitalize on price swings and rack up profits. However, many commodities-intensive businesses faced substantial challenges in accommodating rising commodity prices while trying to maintain competitive pricing for their products. Adding to these challenges, adverse weather conditions—exacerbated by a warming global climate—negatively impacted the prices of key commodities like cocoa and coffee. While these conditions may present a compelling investment thesis for some, they pose significant hurdles for millions of consumers and businesses alike, as firms struggle to remain competitive and keep prices affordable.

Contact Jeffrey at Jeffrey.Grynaviski@shu.edu