Market Reaction on NVIDIA’s Q3 Earnings

Thaddius Gamueda

Staff Writer

As many companies are reporting their earnings for the third quarter, no other company has as much sway on the market than Nvidia. With a market cap of $3.5 Trillion, Nvidia is the most valuable company in the world. After the market closed on November 20th, Nvidia released their Q3 earnings. How did the market react to the largest company’s earnings, and should investors hit the brakes on buying Nvidia?

A Summary of NVIDIA’s Q3 Earnings

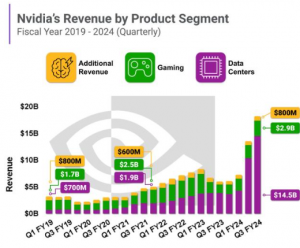

To begin, the third quarter for Nvidia ended on October 27th, 2024. But to truly understand why Nvidia is at the forefront of the market, looking at Nvidia’s data center growth is crucial. The data center revenue was $30.8 billion this quarter, up 112% compared to last year, and was driven by the Hopper computing platform and their new Blackwell chips. Nvidia’s data centers have been a large reason as why their earnings have skyrocketed and pushed them to the forefront of the stock market. Nvidia reported a revenue of $35.1 billion, beating the estimates of $33.2 billion and increased their revenues by 94% compared to last year. According to NBC, 88% of their revenue is based solely on their data centers. Some other crucial information Nvidia reported was that their GAAP earnings per share are $0.81, beating the estimates of $0.74 and are up 111% compared to this time last year. Nvidia’s non-GAAP operating income is $23.276 billion. They also reported a gross profit margin of $26.156 billion and net income margin of $19.309 billion for the quarter. Their gross margins are up 20.4 points compared to this time last year. Although Nvidia beat the forecasts set by analysts and nearly doubled sales, the third quarter results showed a slowdown of growth in their data centers compared to previous quarters. Compared to the last quarter of 2023, where they reported that their data center sales grew a staggering 409%, the third quarter of 2024 has reported only a 112% growth in sales, marking a staggering decrease in less than a year. Even with this setback, Nvidia had another successful quarter, and the future is bright according to CEO, Jensen Huang.

How Did the Market React?

Although Nvidia beat the forecasts, the stock was sliding in pre-market trading of 11/21 and ended at a price of $146.67. Many analysts believed the stock would break the $150 price threshold, but that wasn’t the case. Today, the market is in a wild west phase for AI. There is not a lot of regulation and the technological advancements being made are fast and staggering. The reason for the halted reaction to these earnings is because of the astronomical expectations of Nvidia. The earnings reported would be amazing for any other company, but because Nvidia is at the forefront of the AI revolution, not reaching the bullish expectations of investors has caused stagnation in price at closing. Even if Nvidia did not reach the bullish expectations set onto them, investors should still be high on the company because of the AI arms race that is currently ongoing between rival companies and superpowers of the world.

What is the Future of NVIDIA and the Market?

Even though Nvidia could not reach the bullish expectations everyone has put onto them, technology will still be one of, if not, the largest sectors and Nvidia is the golden child of it. Because of the revenue increase, Deutsche Bank analysts and others are positioning the fourth quarter revenue estimates at around $37-$37.5 billion. CFO Colette Kress has gone on record stating that the demand for Nvidia’s Blackwell chips is enormous and “production shipments are scheduled to begin in the fourth quarter of fiscal 2025 and will continue to ramp into fiscal 2026”. The AI revolution is still in the early stage, and it is very hard to predict where AI will take society in the coming years. Even with this being the case, analysts from companies including Susquehanna, Bernstein, and Melius Research, all believe in Nvidia’s ability to bounce back from the “miss” and have price forecasts of at least $175 up to $190. The main problem that Nvidia is having is that their growth is slowing. The reason why Nvidia is valued so highly in the market is because of their staggering growth compared to other companies. Nvidia’s biggest revenue source, data centers, has gradually slowed down over the year, which means that Nvidia’s stock price may begin to tank if they cannot perform up to the staggering forecasts analysts put onto them. We already have an example of this happening this year when Nvidia’s stock price tanked after the Q2 earnings were released. Because of the external fears of an economic slowdown, Nvidia’s shares dropped 9.5%, leading to a total of $278.9 billion being lost from the company’s value. Investors need to understand that Nvidia only grows through other big tech companies investing in them for their AI technology. If companies slowly begin to pull out of buying from Nvidia, or the AI revolution begins to slow, Nvidia’s place at the top of the market will be in jeopardy and investors need to stay up to date on current events to make sure they aren’t blindsided by another drastic price drop.

Contact Thaddius at Thaddius.Gamueda@student.shu.edu