Nvidia Replaces Intel on the Dow Jones

Sheamus Finnegan

Staff Writer

Since 1999, the chip manufacturer Intel has enjoyed a spot on the Dow Jones Industrial Average Index (DJIA). Now, after a quarter of a century, intel had its spot on the index taken by Nvidia, which has skyrocketed since 2023 due to an increased demand for GPUs suited for artificial intelligence.

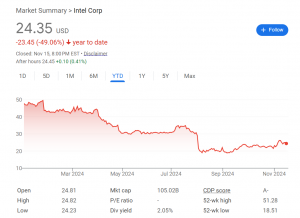

The Dow Jones Industrial Average Index, or simply the Dow Jones, is a highly renowned stock index composed of thirty high-performing stocks from various industries. The Dow is unique because, unlike the S&P 500 which is comprised of the 500 stocks with the highest market capitalization (number of shares multiplied by share price), the thirty stocks that comprise the Dow Jones are chosen by a committee based on various factors, three of which are: company reputation, evidence of sustained growth, and investor interest. By choosing large, established companies that meet these criteria, the stocks on the DJIA can be trusted to be stable and reliable in the long term. It is also worth noting that the Dow is price-weighted, meaning that a stock’s position in the index is determined by the stock’s share price rather than the total market value of the company. Therefore, the stocks comprising the Dow Jones are not only high-cap stocks but also ones that investors place a high value on. Unfortunately for Intel, the price of their stock has plummeted over 35% in the past year while Nvidia’s share price has increased sharply. Nvidia enjoyed a 239% increase in 2023 and a 150% increase so far this year, having recently reached a high of almost $150 per share while Intel hovers around $25.

As things stand now, the outlook for Intel is, at best, uncertain. Intel has not only announced that 15,000 employees will be laid off in an attempt to cut costs, but they have also reportedly received an offer for an acquisition by Qualcomm, another chip company. The main reason for Intel’s decline – the “nail in the coffin,” as one industry analyst described it – was missing out on the AI boom. In recent years, little has gotten investors more excited than the recent surges in AI technology and, in particular, generative AI, for which Nvidia’s graphics processing units (GPUs) are ideal. Nvidia’s GPUs are better suited to the development and use of increasingly sophisticated generative AI tasks than Intel’s central processing units (CPUs) are. Unfortunately for Intel, these less-desired CPUs constitute the company’s main product line. Since public interest remains firmly directed towards AI, Intel’s core product line will continue to suffer.

Meanwhile, Nvidia has become one of the most valuable companies in the United States with its focus on product development, strategic partnerships, and highly demanded GPUs. The Dow’s decision to boot Intel and bring in Nvidia symbolizes this shift. Nvidia will not be gone anytime soon.

Contact Sheamus at sheamus.finnegan@student.shu.edu