Berkshire Hathaway’s Cash Pile Reaches 325 Billion – What Could this Mean?

Peter Gozsa

Staff Writer

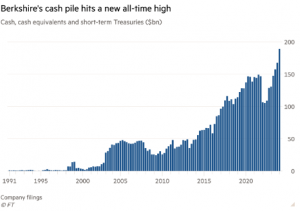

Berkshire Hathaway recently reported a record cash pile of $325.2 billion at the end of the third quarter, sparking a lot of debate about Warren Buffett’s investment strategy, especially given the uncertainty in the market. This huge cash reserve has built up in part because the company has been avoiding major stock investments, which has left many wondering if Buffett is playing it safe in a volatile economic environment. Adding fuel to the fire, Berkshire also made headlines by selling a significant chunk of its Apple shares, raising questions about its outlook on the tech giant.

Key Investment Decisions: Apple

One of the most surprising recent moves was Berkshire’s decision to sell 100 million shares of Apple, cutting its holdings by nearly 25%. Even though Apple remains one of Berkshire’s largest investments—still worth about $69.9 billion—and Warren Buffett has often praised the company for its brand loyalty, innovation, and strong cash flow, the sale was notable. In fact, by the end of the third quarter, Berkshire had sold over 600 million Apple shares in 2024 alone. So, what’s behind this shift? It could be part of a strategic move—perhaps to minimize capital gains taxes or reduce exposure to stocks in a time when valuations are high and the economy is uncertain.

Strategic Caution or a Bearish Stance?

Berkshire’s cautious approach is clear when you look at its recent investment activity. The company only spent $1.5 billion on new stock purchases, a relatively small amount compared to its typical investments. This suggests that Buffett is taking a conservative stance, especially with market volatility and high valuations. What’s even more telling is that Berkshire didn’t buy back any of its own shares, which is something Buffett usually does when he believes Berkshire stock is undervalued. The lack of repurchases indicates that Buffett doesn’t see much value in Berkshire’s stock at the moment, despite the company having ample cash on hand.

This restraint aligns with Buffett’s long-standing investment philosophy: only buy when the price is right and hold back when the market feels overpriced or unstable. By not repurchasing stock and keeping new investments limited, it seems like Buffett is biding his time, waiting for better opportunities rather than taking on more risk in an unpredictable market.

Why the Huge Cash Reserve Matters

Berkshire’s record cash reserve could be a strategic advantage if the markets decline. With $325 billion ready, Buffett could capitalize on a big market downturn. On top of that, Buffett could be holding cash as a safe right now too. Cash can protect Berkshire against potential declining assets but also positions it to grow in the future.

What’s Next for Berkshire?

Despite the cautious move, Berkshire remains very strong. Even with the drop in quarterly profits due to insurance claims, it continues to perform at a high level. Ultimately, Buffett’s strategy reflects his commitment to patience and waiting for the right time. By holding cash and reducing certain investments, he’s making sure that Berkshire can stay ready for the right opportunity. While some might predict a bearish market, it seems more likely that Berkshire is waiting for the right time to make a move.

Contact Peter at Peter.Gozsa@student.shu.edu