Private Equity in the United Kingdom: The Consequences

Scott Kirwin

Staff Writer

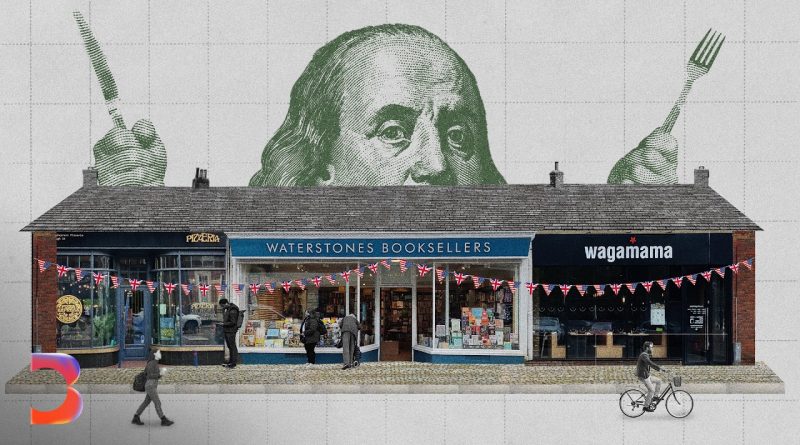

Private equity is a type of investment where investors or a private equity sponsor will purchase a stake in a private company aiming to increase value and sell the firm for profit. Private equity firms will pool capital from investors known as limited partners and utilize leverage to maximize returns. These groups have had a large impact on the economy and the businesses in the United Kingdom.

Private equity started thriving in the 2010s. With economic disruption, private equity groups began investing in established English businesses that then needed funding . A major example of this is the supermarket Morrisons, which has been operating since 1899 . During the Pandemic, Morrisons was struggling as a business and was acquired by a major private equity firm CD&R.

Sometimes, private equity take over can lead to issues in the business and directly affect employees. Not all private equity deals work out and for the ones that don’t, thousands of people end up losing their jobs and face unemployment. To maximize profits, companies resort to cost cutting measures such as layoffs or restructuring. When they do this, many employees are laid off and are left unemployed due to the cost cutting strategies and goals of profit maximization. Additionally, many companies freeze hiring and increase the hours of current employees to maximize profits.

These changes often have a negative effect on the economy in sectors like retail where private equity has taken over. Throughout the UK, this has become a common investment that has devastated the economy, with private equity firms buying well-established brands only to strip them of their resources to improve efficiency. The result of this can be disastrous for the local economy. Private equity firms often display a lack of care for long-term stability. This is because they are only looking to be in control for a short period before they exit from their investment. This is disruptive as such a strong focus on short term growth means a lack of long-term investment in innovation and research. A large focus on the short-term also means utilizing cost cutting measures and layoffs which may be detrimental to the company after the private equity group exits. Additionally, constant buyouts create volatility and uncertainty in the local markets which leads to a lack of confidence from local customers and investors and can be harmful to the economy. The UK has seen the effects of this firsthand, as of 2022 the market size of private equity in the UK reached over 3 billion pounds, indicating a significant increase in investment compared to previous years. This growth shows confidence in investors but also raises doubt about the long-term sustainability of these investments.

Although there have been various negative impacts of private equity in the UK, there are example where a private equity takeover benefited the firms. Private equity groups have provided massive funding to struggling companies and genereted growth through further fundings and expansions in untapped markets. Many startups are bought by private equity groups as well, which is important when they are looking to fund new ideas and bring products to the market. Furthermore, established companies that may be experiencing financial issues could be revived by private equity groups. Companies in the UK that have either been directly bought out by a private equity firm, their sales have been impacted by private equity or have had a percentage of their company sold to private equity include Morrisons, Thomas Cook and Brew Dogs.

While private equity plays an important role in funding the economy and revamping struggling businesses in the UK, it is important to remember that its focus on short-term gains can lead to notable challenges such as job loss and economic instability. The impact of these decisions have been felt across the UK.

Contract Scott at Scott.Kirwin@student.shu.edu