Verizon’s Strategic Step Back: Paving the Way for Slow Domination of the U.S. Fiber Broadband Market

Johannes Sasse

Staff Writer

The U.S. broadband landscape is at a pivotal moment, with fiber technology emerging as a game-changer in an under-developed market. Verizon’s $20 billion acquisition of Frontier Communications aims to accelerate this transformation, promising expanded fiber coverage and strengthened market positioning. Yet, as promising as this deal might seem, its future remains uncertain, teetering between potential triumph or costly misstep. This article explores the intricacies of the Verizon-Frontier deal, examining both its opportunities and the significant risks that could determine whether this acquisition fuels growth or falls short of expectations.

The U.S. fiber broadband market is under-penetrated compared to Europe and Latin America, with only 17% of U.S. broadband subscribers using fiber. The fiber broadband, market is growing rapidly, with double-digit increases in 2023. Despite this, much of the U.S. telecom industry still relies on legacy copper Digital Subscriber Lines, while cable and wireless providers are also expanding fiber. Competition has intensified, with AT&T and T-Mobile leading infrastructure expansions. As of 2023, AT&T has 28 million fiber passings, now followed by Verizon with 25 million after acquiring Frontier’s assets. Fiber is expected to become the dominant U.S. broadband technology.

Verizon and Frontier Communications are both telecommunications companies in the United States, each offering a variety of services to millions of customers. Verizon is one of the largest mobile network operators in the country, providing high-speed internet, phone services, and 5G connectivity to both individuals and businesses. Known for its robust network infrastructure and innovation, Verizon has expanded its offerings through strategic acquisitions and partnerships. Frontier Communications primarily serves rural and suburban areas, offering broadband internet, phone, and television services. Focused on expanding high-speed internet access, particularly through fiber-optic technology, Frontier has worked to modernize its infrastructure and improve customer service following its 2020 bankruptcy.

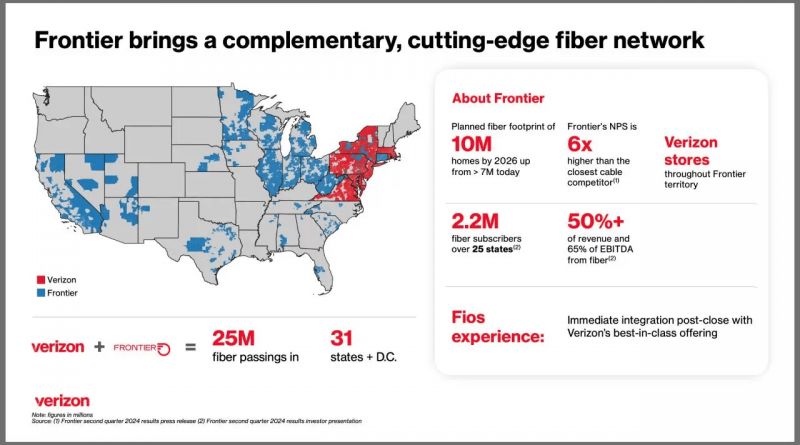

Verizon has agreed to acquire Frontier Communications in a $9.6 billion all-cash deal, valuing Frontier at $20 billion including debt, repurchasing fiber-optic lines it sold to Frontier nearly a decade ago for $10.54 billion. These two transactions are not comparable according to Verizon CEO Hans Vestberg who said that these are “a totally different type” of asset, based on a different standard. The transaction offers Frontier investors $38.50 per share and expands Verizon’s fiber-optic customer base to 10 million across regions such as the Northeast, Midwest, California, Texas, and Florida. Verizon plans to modernize aging infrastructure and expand fiber coverage to 30 million locations by 2026, acquiring Frontier’s 2.2 million fiber subscribers and extending its network to 25 million premises across 31 states and Washington, D.C. The acquisition, expected to close in 18 months, will strengthen Verizon’s position as the third-largest broadband provider and is anticipated to generate at least $500 million in annual cost synergies. This move aligns with Verizon’s strategy of integrating broadband with premium mobility services, boosting revenue, Adjusted EBITDA, customer retention, and market share.

Verizon’s acquisition of Frontier Communications aligns with its long-term strategic goals, primarily driven by the convergence of wireless and wireline assets to create a more integrated service offering. This move strengthens Verizon’s ability to compete with cable companies, which are increasingly bundling services to enter the wireless market. Fiber infrastructure plays a critical role in delivering high-speed internet and supporting the rollout of 5G, enhancing Verizon’s mobile and broadband capabilities. The acquisition allows Verizon to better compete with cable providers offering low-cost wireless services, as its enhanced fiber infrastructure supports superior offerings. By controlling both mobile and fiber assets in key regions, Verizon aims to gain market share and attract more customers through bundled services, fueling growth in both sectors. Additionally, the deal addresses the need to diversify revenue streams, with wireless growth slowing, by expanding its broadband reach, particularly in areas where Verizon can provide both mobile and fiber services. Financially, the acquisition is projected to be accretive to earnings, supporting continued investments and maintaining a strong balance sheet. Verizon will also expand its fiber network, gaining 2.2 million fiber subscribers and extending its reach to 25 million premises across 31 states, aligning with its strategy to integrate mobile and broadband offerings, reduce customer churn, and enhance loyalty. The company anticipates generating at least $500 million in annual cost synergies by year three, driven by increased scale and network integration, further supporting revenue and Adjusted EBITDA growth. Overall, the acquisition enhances Verizon’s competitive position and creates opportunities for continued growth in both fiber and mobility services.

Analysts view Verizon’s acquisition of Frontier Communications’ fiber assets as providing only a moderate boost to its overall market position. The deal will expand Verizon’s fiber coverage by around 3%, bringing its total fiber footprint to roughly 10% of U.S. broadband households, which still trails AT&T’s 15%. However, the deal strengthens Verizon’s competitive position in the increasingly crowded fiber broadband market, allowing the company to enhance its fiber passings to 25 million, close to AT&T’s 28 million. While the acquisition enhances Verizon’s network, analysts like Craig Moffett suggest that the deal alone may not be transformative. Verizon aims to capture more market share in regions where it can offer both wireless and fiber services while generating cost synergies and boosting fiber revenues, which outpaced overall subscriber growth in 2023.

Verizon’s $20 billion acquisition of Frontier Communications was met with skepticism. While Frontier’s stock initially surged 38%, it quickly dropped by 9.5% after the announcement, and Verizon’s shares fell 0.4% following a prior 3% decline. Analysts raised concerns about the deal’s impact on Verizon’s earnings-per-share and free cash flow, fearing it could hurt short-term financials. Verizon’s “convergence” strategy, aiming to integrate wireless and wireline services, was also questioned, as Frontier’s small fiber network may not significantly enhance Verizon’s competitive position. Although the deal could bring long-term benefits through cost synergies and fiber expansion, near-term challenges are expected, and investors may need to be patient.

The Verizon-Frontier deal faces several key risks that could impact its success. First, regulatory approval is required, and authorities may scrutinize the acquisition for potential antitrust concerns, particularly in regions where the combined company could dominate the broadband market. Verizon’s increased debt load post-acquisition could also raise red flags for investors and credit rating agencies, potentially complicating the financing or leading to negative market reactions. Moreover, there are execution risks involved in integrating Frontier’s assets, including infrastructure upgrades and service alignment, which could delay expected benefits or reduce cost synergies. Lastly, competitors such as AT&T, T-Mobile, and cable providers may respond with aggressive pricing or enhanced offerings, making it more challenging for Verizon to fully realize the strategic value of the deal.

The Verizon-Frontier deal presents both significant opportunities and notable risks in the evolving U.S. fiber broadband market. While it promises to expand Verizon’s fiber coverage and strengthen its competitive position, challenges remain, particularly in regulatory approval, debt management, and integration. The deal is also met with skepticism from analysts, who question its short-term financial impact and transformative potential, due to the size of Frontier. As the market becomes more competitive, Verizon’s ability to fully capitalize on this acquisition will depend on successful execution and strategic positioning. Ultimately, the future of this deal remains uncertain, with the potential to either drive growth or struggle amid industry complexities.

Contact Johannes at Johannes.Sasse@student.shu.edu