Tesla & Musk’s Compensation Battle – From Courtroom to Boardroom

Mark Walier

Tech Editor

In a dramatic turn of events that underscores the complexities of modern-day corporate governance, Tesla Inc. is set to hold a crucial vote that could see the reinstatement of a previously voided $56 billion compensation package for its CEO, Elon Musk. This shareholder decision, scheduled for June 13, 2024, not only has significant implications for Musk but also for Tesla’s future trajectory amid declining sales and market challenges.

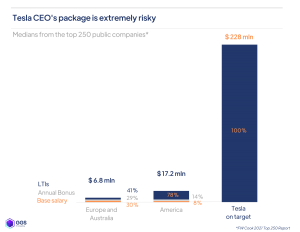

The backstory of this unprecedented compensation package begins in 2018, when Tesla shareholders initially approved what would become one of the largest pay packages ever awarded to a CEO. Structured around ambitious growth milestones, the package offered Musk stock options that could vest only if certain operational and market value targets were met. As we know, Musk’s leadership led to outstanding business performance, making his pay package all the more lucrative. Fast forward to January 2024, a Delaware Court, led by Chancellor Kathaleen St. Jude McCormick, voided this package, citing an unfair process influenced overly by Musk’s dominant presence at Tesla. This decision was grounded in concerns that Musk had undue influence over the board members responsible for his compensation, thus compromising the fairness to other shareholders.

Despite this legal setback, Tesla’s board is taking a bold step by asking shareholders to reapprove the same package. This move comes with a strategic shift in Tesla’s corporate headquarters from Delaware to Texas, a decision also up for vote at the same meeting. Tesla argues that this relocation and the reinstatement of Musk’s pay are in the best interests of the company and its shareholders, pointing to the significant growth Tesla has experienced under Musk’s leadership—a 571% increase in share value since the package’s inception.

The context of this vote is crucial. Tesla faces a series of operational and market challenges, including a significant decrease in global electric vehicle demand, layoffs affecting about 10% of its workforce, and a 37% decline in its stock price year to date. These factors make the upcoming vote particularly contentious, as shareholders weigh the potential benefits of incentivizing Musk against the optics and ethics of approving a massive pay package during times of tightening performance.

Proponents of the pay package argue that Musk’s leadership and vision are indispensable for Tesla’s continued innovation and market leadership, especially as the company aims to expand its technology frontier into artificial intelligence and robotics. Opponents, however, point to the recent performance dips and the ongoing controversy around Musk’s leadership style, suggesting that such a large compensation might not be justifiable under the current circumstances.

This shareholder meeting is not just about approving a compensation package; it’s a referendum on Musk’s future role and the strategic direction of Tesla. The outcome could significantly impact investor confidence and Tesla’s ability to attract future capital. It also poses broader questions about the balance of power in major corporations and the mechanisms of accountability in executive compensation.

This situation illustrates key concepts such as corporate governance, shareholder rights, and executive compensation—areas that are pivotal in understanding the dynamics within major corporations. As college students and future business leaders, these dynamics are important. Additionally, the decision has broader implications for corporate ethics and accountability, especially concerning the influence and power of high-profile CEOs in shaping company policy and direction.

Contact Mark at mark.walier@student.shu.edu