Earnings Season: Tech Still on Top

Jacob Hummel

Finance Editor

Article is written as of April 27th, 2024.

With earnings season underway, megacap tech continues to drive the markets. On Friday, both the S&P 500 and the Nasdaq finished their best week since November, up 2.7% and 4.2% respectively, both snapping losing streaks. Indices saw a slight sell off in the last few weeks, due to uncertainty in the Middle East and hot economic data that pushed back rate cut projections. However, big tech continues to be the story of 2024, as earnings from Mag 7 companies revitalized excitement in the markets.

Tesla kicked off the week on Tuesday, as the first of the four tech giants to report earnings this week. The numbers themselves were not impressive, as the automaker missed both earnings and revenue expectations. Tesla reported earnings per share of $0.45, missing analysts’ expectations of $0.51. Top line growth was underwhelming as well, actual revenue was $21.3 billion, missing analysts’ expectations of $22.5 billion. This reflects a 9% decline in year-over-year revenue, the worst for the company since 2012. Despite these lackluster results, the stock jumped 13% after the earnings call following comments from CEO Elon Musk announcing that Tesla plans to begin production on a new affordable EV model in 2025. This announcement provided some much-needed investor confidence, as prior to the call Tesla’s stock price was down more than 40% this year.

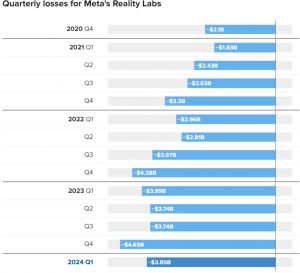

Meta reported earnings on Wednesday afternoon, and their call went the opposite of Tesla’s. Meta beat analysts’ expectations on both the top and bottom line. Earnings per share was $4.71 compared to $4.32 in expected earnings. Actual revenue was $36.46 billion compared to expected revenue of $36.16 billion. However, the stock fell 10% on Thursday, erasing around $130 billion in market cap for the tech giant. This selloff was prompted by lackluster forward guidance, and an emphasis on increased spending on metaverse and AI projects.

However, the week finished strong with both Alphabet and Microsoft reporting after the bell on Thursday. Not only did Alphabet beat earnings expectations, but they also authorized its first ever dividend and a $70 billion share buyback plan. The company saw tremendous ad revenue growth, especially from YouTube and Google Search, which was previously an area for concern for investors. Between both Alphabet and Meta, it is clear that digital advertising is still performing extremely well and remains lucrative for big tech. After reporting, Alphabet jumped over 10% on Friday, and had its best day since July 2015.

Microsoft also beat both earnings and revenue projections. They reported 17% revenue growth year-over-year. This was driven by strong revenue growth from their cloud businesses. Total cloud services revenue grew 31%, compared to expectations of around 28.8%. Microsoft attributed 7% of this growth to AI. Microsoft closed on Friday up around 2%.

One important shift to note is that it seems investors are beginning to expect results from big AI investments. This week we saw a positive reaction to Microsoft’s AI driven revenue growth, where Meta was punished for funneling excess cash into the venture.

Overall, the strong earnings from these megacap tech companies have renewed excitement in the equity market after a brief pullback. As we close the week, eyes shift to Apple and Amazon, who are the next two big names to report earnings. The bar has been raised for the remaining companies waiting to release earnings, and with a Fed rate decision on the horizon, we should expect to see lots of activity in the markets in the upcoming weeks.

Contact Jacob at hummelja@shu.edu