Economists Forsee Speculators Affecting The Canadian Housing Market

Radha Patel

International Business News Writer

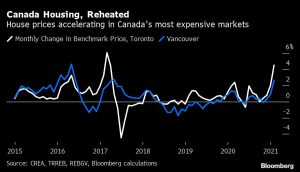

The Canadian housing market has been experiencing a large surge in demand for larger living spaces, leaving a dwindling supply that has made housing prices climb. In fact, the average price of buying a home in Toronto just surpassed 1 million dollars, which represents a 15% increase just over the past year alone. However, it was reported that Canada only has approximately two months of housing inventory left. Buyers are worried that they will miss out on the sudden boom in housing sales, so the rapid sales are going at record speed.

In contrast to the current surge in housing prices, speculators had actually anticipated a decline, as of May 2020. More specifically, the Canada Mortgage Housing Corp. (CMHC) expected a 7% decrease in sales and prices mid-last year. The agency reversed those predictions, as the market began to pick up more speed. The housing prices experienced a 7% increase in fact, since 2019. Such an increase in prices likely took the CMHC and other speculators by surprise, because of the state of world affairs amidst Covid-19. Nonetheless, the availability of buyers has gone up. Canadian leaders and policymakers are considering imposing restrictions over concerns of buyers from lower economic backgrounds. At the same time, the economy is still recovering from the pandemic and is still in a fragile state as circumstances keep changing. Bank of Canada Governor, Tiff Macklem believes that this is not the right time to tighten regulations, despite signs of excess exuberance.

Three months ago, Prime Minister Justin Trudeau’s government planned to introduce the foreign buyer’s tax. Other measures could also include a flipper’s tax, says Derek Holt, an economist at Bank of Nova Scotia. The flipper tax would be imposed on those who sell the property within a small margin of time of buying. Additionally, there is the option of changing mortgage qualification rules, according to Benjamin Tal, deputy chief economist at Canadian Imperial Bank of Commerce.

If none of these policies are introduced, then the current plan is to simply let the market cool down on its own. It may be enough to talk down the market by encouraging the prices to decline, according to one broker. Right now, the situation will continue to be monitored to determine the next course of action. Although Canada may seem in a position of breaking its next housing bubble since the late 1990s, perhaps the shift in sales can be seen as an opportune moment for the country to renew itself after the pandemic.

Contact Radha at Radha.Patel3@student.shu.edu